Closing Loopholes Part 1 Fair Work Act Amendments

By Paolo, 25.01.2024

The first part of the Closing Loophole Bill: ‘The Fair Work Legislation Amendment (Closing Loopholes) Act 2023’ received Royal Assent on 14 December 2023.

The introduction of this new range of workplace reforms followed the previous amendments implemented as part of ‘The Secure Jobs Better Pay Act’ 12 months earlier. The last of its workplace reforms, ‘ Limitation of Fixed-term Contracts,’ came into effect only a week before the beginning of the Closing Loopholes Act on December 6, 2023.

Similar to the Secure Jobs Better Pay Act 2022, the Closing Loopholes Act is not independent legislation. It consists of a range of amendments applied to the Fair Work Act 2009, implemented in stages from December 2023 to January 2025.

This blog article provides a brief overview of the changes proposed with the introduction of the Closing Loopholes Act based on their implementation dates.

15 December 2023

15 December 2023

Regulated Labour Hire Arrangement Jurisdiction (Same Job, Same Pay)

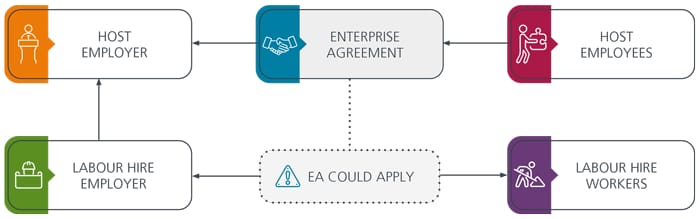

This legislation amendment addresses pay disparities and ensures that employees performing the same or substantially similar roles are paid equally, whether hired directly as employees or as part of a labour-hire arrangement.

It only applies to Non-Small Employers (businesses that employ over 15 employees) that engage in Labour-hire arrangements for periods of over 3 months together with employees engaged under an Enterprise Agreement.

The essence of the Same Job, Same Pay amendment is that employees who perform the same or similar roles should receive the same pay whether they are engaged as employees or labour-hired workers.

The provision covers all remuneration components, including base pay rates, allowances, bonuses, commissions, and other benefits. However, it also considers experience, qualifications, and performance levels.

Employees, unions and host employers can apply to the Commission to issue a ‘regulated labour-hire arrangement order’.

This order requires labour-hire employers to pay their employees the same rate of pay as the employees of the host employer who perform equivalent work as determined by the Enterprise Agreement.

Any regulated labour-hire arrangement order issued by the Fair Work Commission won’t come into effect until 1 November 2024.

Small Business Redundancy Exemption Provisions

Small Employers (Businesses employing 15 employees or less) are generally not required to pay the severance payment component of a Genuine Redundancy (unless their Industry Award includes a Small Business Redundancy provision).

The Small Redundancy Exemption Amendment introduces an exception for businesses downsizing from non-small to small employers due to insolvency.

In this instance, these businesses may still be required to pay the severance pay when terminating their last employees under Genuine Redundancy.

For example, if an employer is winding up operations and a core group of employees is temporarily retained to support the winding down process, once their employment is terminated under Genuine Redundancy, the employer is still obligated to pay redundancy pay even if the business has fallen under the Small Employer threshold.

Protections for employees subject to Family and Domestic Violence

After the introduction of Paid Family and Domestic violence leave in 2023, Fair Work has also increased the rights and protections to safeguard employees subject to Family and Domestic Violence.

The amendment includes the prohibition of:

- discriminatory terms in modern awards and enterprise agreements;

- the employer taking adverse action on specified discriminatory grounds, and

- the employer terminating employment on specified discriminatory grounds.

This means that it’s unlawful for an employer to take adverse action (including dismissal) against an employee who has been experiencing family and domestic violence.

Workplace Delegate Rights Provisions

A workplace delegate is an employee appointed or elected under the rules of an employee organisation to represent employees in the organisation.

Under this new provision, Workplace Delegates have been granted additional entitlements, including the right to:

- represent other union members and everyone eligible to join the union concerning ‘industrial activities’;

- request the employer to communicate with them regarding relevant ‘industrial activities’ instead of the employee;

- receive reasonable access to both time and workplace facilities (i.e. meeting rooms) to meet with other employees during work hours;

- carry out these activities without loss of pay;

- receive reasonable paid time off to attend union training sessions and meetings both on and off-site.

Industrial activities include the following:

- being involved in setting up a union or employer association;

- organising, promoting or participating in lawful activities for or on behalf of a union or employer association;

- representing the views, claims or interests of a union or employer association;

- following lawful requests made by a union or employer association;

- paying a fee to a union or employer association;

- asking a union or employer association to represent another employee.

From 1 July 2024, additional rights tailored to specific industry requirements must also be included across all Industrial Instruments.

Compulsory conciliation conferences in protected action ballot matters

A protected action ballot is a secret vote by eligible employees on whether they want to take industrial action for a proposed enterprise agreement.

Where the Commission has made a protected action ballot order about a proposed enterprise agreement, they must make an order directing all bargaining representatives to attend a mediation or conciliation conference, including:

- the employee representatives who applied for the protected action ballot order;

- the employer and/or any bargaining representative of the employer.

Right of Entry

The Act also amends provisions relating to entry permit conditions for organisations’ representatives who require entry into an employer premises to exercise Occupational Health and Safety functions (OHS).

Under the Fair Work Act, organisations’ representatives seeking to exercise the functions of O&HS officers are no longer required to hold an entry permit.

Additional Amendments

Other workplace changes that impact workers’ compensation and workplace health and safety include:

- expanding the functions of the Asbestos Safety and Eradication Agency;

- streamlining the Comcare workers’ compensation claims processes for certain first responders who sustain post-traumatic stress disorders.

1 July 2024

1 July 2024

Industrial Manslaughter

The Closing Loopholes Act also introduced a new offence of Industrial Manslaughter for Commonwealth Work Health and Safety Act jurisdiction breaches.

This amendment to the Commonwealth jurisdiction aligns with the Queensland and ACT state and territory act.

From 1 July 2024, Industrial Manslaughter includes:

- increased sections for Category 1 offences under the Work Health and Safety Act 2011 (Cth) of up to 16 million dollars, and

- criminal sanctions of up to 25 years imprisonment for individuals applicable to the most egregious breaches of safety duties in the workplace.

Workplace Delegate Rights included in all Industrial Instruments

All Fair Work Awards and Enterprise Agreements must include a section detailing specific terms for workplace delegates’ rights tailored to the Industry Sector (Awards) or business requirements (Enterprise Agreements).

1 January 2025

1 January 2025

Criminalisation of Wage Theft

The final amendment of the Closing Loopholes Act is the criminalisation of intentional wage underpayment.

This amendment to the Commonwealth jurisdiction aligns with the state Acts in both Queensland and Victoria introduced in previous years.

Wage theft breaches include employers who are required to:

- pay a set pay rate as established by the classified Industrial Instrument (Award or Enterprise Agreement) to employees, and they intentionally pay under such rate;

- pay benefits on behalf of employees (such as superannuation), and they intentionally pay under the required rate or amount, or after the day they’re due to be paid;

In order to establish the Wage Theft offence, the fault element of intention must be proven, meaning employers must have intended not to pay the required amount in full when it was due and were aware of their obligations.

The offence does not capture inadvertent or unintentional underpayments.

Employers deemed to have intentionally committed wage theft may be subjected to the following penalties:

- if the court can determine the underpayment, the greater of 3 times the amount of the underpayment and $7.825 million, or

- if the court can’t determine the underpayment of $7.825 million,

- a maximum of 10 years imprisonment for individuals involved in the breach.

Note: the definition of ‘individuals’ includes business owners and Company Directors who employ staff.

However, it also comprises any other individuals deemed complicit in the breach (a person who aids, abets, counsels, or procures the commission of an offence by another), covering both senior managers and external consultants, as set out by Section 550 of the Fair Work Act, ‘Accessorial Liability’.

These provisions only pertain to intentional Wage Theft offences committed from 1 January 2025.

Additional exemptions apply to certain employees for:

- superannuation contributions;

- payment for taking long service leave payments;

- payment for taking leave connected with being the victim of a crime;

- payment for taking jury duty leave or for emergency services duties.

Finally, the legislation also includes a Voluntary Business Wage Compliance Code, where small businesses won’t be criminally prosecuted if they voluntarily disclose the breach to the Fair Work Commission. However, the Wage Compliance Code won’t exempt them from civil penalties.

Conclusions

After 13 years of Liberal Government, the Labour Government intends to deliver on their election promises and secure even more robust workplace relations.

With many amendments to industrial relations introduced in 2023 and additional amendments originally proposed as part of the Closing Loopholes Act and set aside for review in the new year, 2024 does not seem to slow down.

With more changes on the horizon, the risk for small business employers of not engaging Payroll and HR professionals to support their business is becoming more dangerous than ever before.

If you are concerned about keeping up to date with employment laws, implementing these changes and updating your Payroll Settings and HR processes, contact us for support.

References

https://www.fairwork.gov.au/newsroom/news/closing-loopholes-fair-work-act-changes

https://www.dewr.gov.au/closing-loopholes

Disclaimer

This blog and attached resources are of general nature designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.