Director Identification Numbers

By Paolo, 06.12.2021

The Treasury Law Amendment ‘Registries Modernisation and Other Measures Act 2020’ received Royal assent on 22 June 2020. The first component of this new legislation (Part 9.1A) is the introduction of a new regime that requires all Company Directors to obtain a Director Identification Number or DIN from the 1st November 2021.

The introduction of Director Identification Numbers forms part of the Government’s implementation of the Program: ‘Modernising Business Registers’ managed by the Australian Business Registry Services or ABRS. The ABRS is a new ATO entity, designed to regulate and streamline the Australian Business Register process currently managed by the Australian Security Investment Commission (ASIC).

ABRS aims to create a single source of trusted and accessible business data, with the introduction of DIN as its first service to be delivered. As the first of its kind in Australia, this new regime will impact both Australian and Foreign Company Directors.

What is a Director Identification Number (DIN)

A Director Identification Number is a unique 15-digit identifier used to verify the identity of a Director. The DIN is assigned to individuals and it’s linked to their personal Tax Profile. An individual can only have one Director Identification Number which can then be assigned to multiple entities.

Company Directors are legally required to obtain a Director Identification Number from ABRS starting from the 1st November 2021. The DIN is permanently assigned to the individual Director even when such person changes Company, stops being a Director, changes name or moves overseas.

The Purpose of Director Identification Numbers

The rollout of Director IDs will enable the Australian Government to keep track of Directors’ identities in order to:

- prevent the use of fabricated or fraudulent identities;

- make it easier to trace directors’ relationships with companies;

- identify and eliminate director involvement in unlawful activity such as phoenix activities.

Currently, when registering for a new Company, Directors are required to provide their details to ASIC. However, ASIC does not verify directors’ identities, enabling Company registrations made to false individuals. Furthermore, the lack of identity verification makes It difficult to trace a director’s relationships across multiple Companies, especially if any of these Companys have ceased to operate due to Bankruptcy or Voluntary Administration.

The ‘Modernising Business Registers’ Program plans to overcome these issues by straightening data integrity and personal identification, a constant battle in preventing Phoenix activities by both the ATO and ASIC.

The new system will also support small businesses by banning Operators that deliberately avoid paying liabilities closing down indebted companies and transferring assets to other entities. Phoenix Activity harms Employees, Creditors, and the general public through tax losses.

However, preventing Phoenix activity is not the sole purpose behind Director Identification Numbers. DINs will also help safeguard Directors’ privacy by allowing Directors to be identified on public registers without disclosing personal information, including residential addresses and date of birth. This is particularly important, especially in consideration of the increasing risks of cybercrime and identity theft.

Roll Out Process

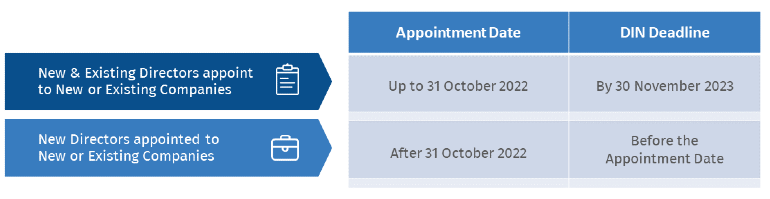

The deadlines to apply for a Director Identification Number vary depending on the Director’s Appointment date and the type of Director based on the applicable Corporations Act.

Corporations Act 2001

Corporations Aboriginal and Torres Strait Islander (CATSI) Act 2006

Future Directors

Individuals who plan to become Directors for the first time can apply for a Director Identification Number within 12 months from their Appointment Date. If the Appointment does not proceed within 12 months from the application date, the DIN is automatically cancelled.

Australian Residents and Foreign Residents

Director Identification Numbers are a legal requirement for both Australian and Foreign Residents. Whilst the DIN provided is the same, the application process differs: Australian Residents can apply for DINs online or over the phone, whereas the application for Foreign Residents is, at this stage, paper-based.

The ATO has estimated approximately 2.7 million Directors of companies in the ASIC Company Register with an expected 2 million to be transitioned to the new ABRS’ Register. The ATO has also assessed that 70% of these Directors fall into the Small Business Category.

Application Process

Who is required to apply?

Director Identification Numbers are legally required for Directors or alternate Directors (acting Director) of a:

- Company (Propriety Limited);

- Registered Australian body that is a Body Corporate;

- Registered Foreign Company that is a Body Corporate;

- Registered Charities.

DINs are currently not required for Shadow Directors, De Facto Directors, Company Officeholders, Company Secretaries, Treasurers and External Administrators.

As a core part of the process is to prove the person’s identity, it is a legal requirement that the Director applies directly for their own Identification Number and not delegate the task to someone else.

How can a Director apply?

There are three types of applications:

- Online (available for Australian Residents only);

- Phone (available for Australian Residents only);

- Paper-Based (available for both Australian and Foreign Residents).

Evidence Required

To successfully obtain a Director Identification Number the applicant must certify their own identity by providing two types of identity documents, a Primary and a Secondary type.

Online Applications

Applicants can submit their applications online via the ABRS website. Login is required via MyGovID.

The MyGovID credentials will automatically provide the Primary Identity proof.

The Applicant will then need to provide two of the following secondary Identity proofs:

- Bank Account Details (BSB and Account number linked to the ATO through their MyGov account);

- Notice of Assessment (lodgement date and Document ID number – this can also be found on their MyGov account)

- PAYG payment summary / STP Income Statement issued in the previous two years (Gross Income in whole dollars);

- Centrelink Payment Summary issued in the previous two years (Gross Income in whole dollars);

- Super Account Details where the Director made contributions within the previous 5 years (member number and Superfund ABN);

- Dividend Statement issued in the previous two years (Investment Reference Number).

Phone and Paper-Based Applications

Applicants can contact ABRS on 13 62 50 to apply for a DIN over the phone.

To apply by Paper applicants should download and complete the DIN Application Form then send the complete form and supporting evidence to ABRS at the following Postal Box:

Australian Business Registry Services

Locked Bag 6000

ALBURY NSW 2640

Applicants will need to provide evidence (phone applications) or Certified Copies (Paper Applications) of one of the following Primary Identity Documents:

- Birth Certificate;

- Passport;

- Australian Citizenship Certificate;

- ImmiCard;

- Visa.

Plus one of the following Secondary Identity Documents:

- Medicare Card;

- Driver’s License;

- National photo Identification Card;

- Marriage Certificate;

- Any other type of Foreign Government Identification.

Documents can be certified by:

Within Australia:

- A Legal or Medical Practitioner;

- A Justice of the Peace;

- A Minister of Religion (authorised to celebrate marriage);

- A Police Officer;

Outside Australia

- A Public Notary;

- A Staff Member from their local Australian Embassy or Consulate.

Identity documents in a language other than in English must be translated into English by an authorised translation service and also be certified as a true and correct copy.

We have created a comprehensive User Guide to help Directors apply for a Director Identification Number online. The User Guide is available to our Clients on our Knowledge Base website.

Future Use & Requirements

Maintaining DINs Information Current

Directors are required to maintain the DIN information current by updating their DIN records every time their personal details change. This can be done online via the ABRS website.

The ASIC requirements for Directors to notify their companies within 7 days of any changes and for the relevant company to notify ASIC within 28 days of such changes will still be in place until the Company Register and DINs will be integrated into the one system.

Future Use & Requirements

In the Future Directors will be required to provide their Director Identification Number to their Company Secretary in order to link the DIN to the Companies they are appointed to as Directors.

However, this step will not be available until the Company Register is transferred from ASIC to the new ABRS servers. This is planned for completion in 2023.

Finally, at this stage, DINs are not searchable by the public. It is unclear what information will be publicly available once the Company Register moves to ABRS.

Penalties & Charges

Failure to meet compliance obligations or making fraudulent identity claims in relation to a DIN may incur infringement notice or civil penalties (up to 5,000 penalty units, currently $1.11 million) as well as criminal charges (up to 12 months imprisonment).

Offences may be associated to:

- failure to comply with application deadlines;

- failure to keep DIN updated;

- apply to multiple DINs using false information;

- general conduct that will undermine the DIN regulations.

References

https://www.abrs.gov.au/director-identification-number

https://www.legislation.gov.au/Details/C2020A00069

Disclaimer

This blog and attached resources are of general nature designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.