FY 2022 Fair Work Annual Minimum Wage Increase

By Paolo, 20.06.2021

On Wednesday, 16 June 2021, the Fair Work Commission announced a 2.5 % increase to the National Minimum Wage and Awards’ Pay Conditions, following its Annual Wage Review. The increase will apply for both the National Minimum Wage and eventually to all Awards’ Pay Conditions. The increase will be effective on the first full pay period on/after the pay increase date.

As of 1st July, employment costs will increase by 2.5% on Wages and by 0.5% on Superannuation.

Minimum Wage Increase

Once again this year the Fair Work Commission took a very careful approach in reviewing and increasing minimum wages, with COVID-19 hotspots and occasional Quarantine periods still happening in Australia. However, Fair Work Commission President Justice Iain Ross also acknowledged the vastly different economic conditions from the previous Financial Year.

“There was a broad consensus in the submissions before us that the current performance of the economy has exceeded expectations and that the economic recovery is well underway,” Iain Ross.

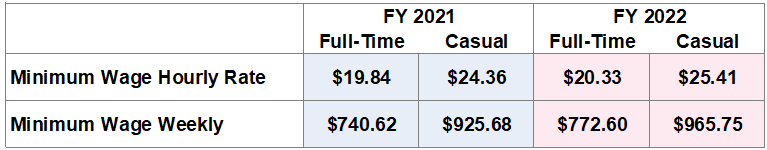

From 1st July 2021 the minimum wage rates will be:

An updated Fair Work Information Statement will be made available to Employers for download.

Modern Awards’ Increase

The Fair Work Commission took a careful approach in rolling out this year’s increase to all Industries, acknowledging that some industries are still feeling the effect of COVID-19. Therefore, similarly to last year, the increase will take in different stages across the year.

Most Awards will increase from the 1st July 2021, at the same time as the minimum wages. The aviation, tourism and hospitality, and the fitness sectors will have to wait until 1 November for a pay rise, while the Retail Award will increase from 1 September 2021.

In detail, the following Awards will increase by 2.5% after 1 September 2021:

Effective from the first full pay period on or after 1 September 2021

- General Retail Industry Award 2020

Effective from the first full pay period on or after 1 November 2021

- Air Pilots Award 2020

- Aircraft Cabin Crew Award 2020

- Airline Operations – Ground Staff Award 2020

- Airport Employees Award 2020

- Airservices Australia Enterprise Award 2016

- Alpine Resorts Award 2020

- Amusement, Events and Recreation Award 2020

- Dry Cleaning and Laundry Industry Award 2020

- Fitness Industry Award 2020

- Hair and Beauty Industry Award 2010

- Hospitality Industry (General) Award 2020

- Live Performance Award 2020

- Mannequins and Models Award 2020

- Marine Tourism and Charter Vessels Award 2020

- Nursery Award 2020

- Racing Clubs Events Award 2020

- Racing Industry Ground Maintenance Award 2020

- Registered and Licensed Clubs Award 2020

- Restaurant Industry Award 2020

- Sporting Organisations Award 2020

- Travelling Shows Award 2020

- Wine Industry Award 2020

Traineeship Wage Rates

Trainees pay conditions are included on Schedule E of the Miscellaneous Award (MA00104). The 2.5% increase in their pay condition will apply on the same date of the trainee’s industry or occupation award that covers them.

For example:

A trainee working in Childcare will receive an increase of 2.5% on their pay rate as of 1 July 2021, as the Children Services Award is part of the Awards increasing on 1st July.

A trainee working in a Fitness Centre instead, won’t receive the increase until 1 November 2021, as the Fitness Industry Award is scheduled to increase on this date.

Tips for Employers

Employers should review and update both Payroll processes and documentation to reflect the above changes. In detail:

- Communicate with your employees

Email employees to let them know about the pay increase, and how they will positively affect their pays. - Update your Employees’ Pay Rates in your Accounting Software

Ensure the employee pay rates are updated by no later than the applicable effective date of the pay increase. This is also an ideal time to review their employment duties and re-assess their classified levels. - Re-test your employees’ Annual Salary or rates above their classified Award

Ensure that any employees paid an Annual Salary or on pay rates above the Award, are still meeting the BOOT Test Criteria (Better Off On All Terms) - Update recurring wages bank transfers

Any regular wages bank transfers should be stopped and updated with the new amounts once the new Tax Tables (and Fair Work pay increases) are applied to Payroll. Also, consider speaking to your Bank about starting to pay employees using Batch Payments (aba files) - Update your Payroll Documentation

Ensure your Payroll Documentation is updated. This includes: update the Fair Work Information Statement in your onboarding documents and download the new Pay Rates.

As always we are at your disposal if you require assistance with meeting your Payroll compliance obligations.

References

https://www.fairwork.gov.au/about-us/news-and-media-releases/website-news/annual-wage-review-2021

https://www.fairwork.gov.au/pay/minimum-wages/apprentice-and-trainee-pay-rates

Disclaimer

This blog and attached resources are of general nature designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.