Key Rates and Thresholds FY 2025

By Paolo, 03.06.2024

Fair Work Australia and the ATO have released new Key Rates and Thresholds applicable for the Financial Year 2025. Here are some of the most significant ones affecting Australian businesses and individuals.

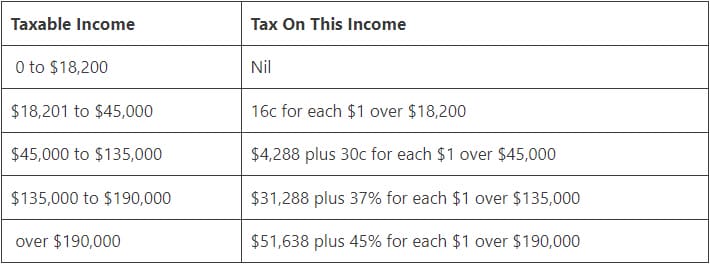

Individual Tax Rates

On 25 January 2024, the Australian Government announced changes to the Individual Income Tax Rates commencing on 1 July 2024.

The new tax rates provide tax cuts for individuals on both the lower and high-income scales.

Here’s a table summary of the new Individual Tax Rates starting from 1 July 2024.

Payroll Key Rates and Thresholds

Fair Work Minimum Wage and Award Pay Conditions

The National Minimum Wage has increased for FY 2025 by 3.75%. The new Minimum Wage Pay Rates are:

- $24.10 Hourly Rate (Full-Time Employees*)

- $915.80 Weekly Salary (Full-Time Employees*)

*25% Loading still applies to Casual Employment

This percentage will also apply to most of the Modern Awards’ minimum wages, except for the following:

- Early childhood education

- Care workers

- Disability home care workers

- Social and community services workers

- Dental assistants

- Medical technicians

- Psychologists

- Other health professionals

- Pharmacists

The Fair Work Commission will complete a review of the above Industry Sectors and announce a separate increase rate within the next few weeks. We will update this blog with the rate applied to the above Industries as soon as Fair Work announces them.

Allowances

Laundry and Dry Cleaning Allowance

The annual tax-free laundry allowance remains at $150 per annum.

Car, Meals and Travel Allowances

The cents per km threshold for FY 2025 has increased to $0.88 per km.

The Overtime Meal Allowance threshold for FY 2025 has increased to $37.65 per meal.

The FY 2025 Overnight Travel Allowances have been updated as per the below document.

ATO – Dry Cleaning and Laundry Allowances

ATO Overnight Travel Allowances TD 2024/3

Superannuation Key Rates and Thresholds

The percentage of Superannuation Contribution Guarantee has increased to 11.5% of Ordinary Time Earnings.

The minimum monthly threshold of $450 per month was removed from 1st July 2022.

The quarterly superannuation maximum contribution cap has increased for FY 2025 to $65,070 wages per quarter (allowing a maximum amount of Quarterly Superannuation Guarantee Contribution of $7,483.05).

The annual Concessional Contribution has increased to $30,000 per annum with the ability to carry forward unpaid contributions for a 5-year period.

The Annual Non-Concessional Contribution cap has also increased to $120,000 with the ability to carry forward unpaid contributions for a 3-year period.

ATO – Superannuation Key Rates and Thresholds

Lump Sums and Employment Terminations

Genuine Redundancy and Early Retirement Payment Limits

The limit of the Tax-Free Component for Genuine Redundancy and Early Retirement Scheme has increased for the FY 2025 to the following:

- Base Limit: $12,524

- Each Year of Completed Service: $6,264

Death & Life Benefits ETP & Whole of Income Cap

The ETP cap for both Death & Life Benefits has increased for FY 2025 to $245,000.

The Whole of Income Cap stays at $180,000.

ATO – Tax-Free on Genuine Redundancy

ATO – ETP and Whole of Income Caps

Payroll Tax Rates and Thresholds

The applicable Payroll Tax rates and thresholds for the FY 2025 are the following:

- ACT – The Payroll Tax rate and thresholds remain unchanged at 6.85% with an annual threshold of $2 million in annual Australian Taxable wages;

- NSW – The Payroll Tax rate and thresholds remain unchanged at 5.45% with an annual threshold of $1.2 million in annual Australian Taxable wages;

- NT – The Payroll Tax rate and thresholds remain unchanged at 5.50% with an annual threshold of $1.5 million in annual Australian Taxable wages;

- QLD – The Payroll Tax rate and thresholds remain unchanged from 4.75% to 4.95%, with an annual threshold of $1.3 million in annual Australian Taxable wages;

- SA – The Payroll Tax rate and thresholds remain unchanged at a maximum of 4.95% with an annual threshold of $1.5 million in annual Australian Taxable wages;

- TAS – The Payroll Tax rate and thresholds remain unchanged at 6.1% with an annual threshold of $2 million in annual Australian Taxable wages;

- VIC – The Payroll Tax rate and thresholds remain unchanged at 4.85% or 2.425% (applicable to regional employers) with an annual threshold increase to $900,000 in annual Australian Taxable wages

Note: although the Annual Threshold has increased to $900,000. From this Financial Year the full Annual Threshold only applies or businesses with wages up $3 mil. Businesses with wages between 3 and 5 mil receive a pro-rata of the Annual Threshold, and finally, business with over $5 mil in wages no longer receive any threshold; - WA – The Payroll Tax rate and thresholds remain unchanged at 5.5% with an annual threshold of $1 million in annual Australian Taxable wages;

Motor Vehicles Key Rates & Thresholds

The Income Tax and GST Threshold for purchasing a new car has increased for FY 2025 to $69,674.

The Luxury Car Threshold for the FY 2025 has increased to the following:

- $80,567 (Non-Fuel-efficient vehicles)

- $91,387 (Fuel-efficient vehicles)

ATO – Luxury Car Tax Rates and Thresholds

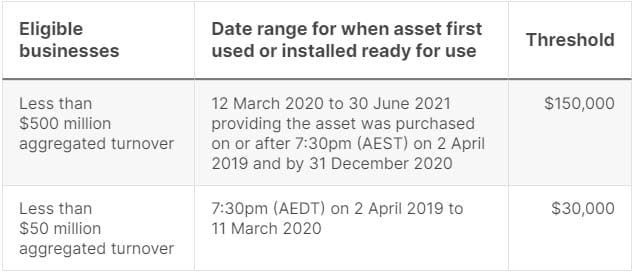

Instant Asset Write-Off

The Instant Write-Off for Fixed Assets valued up to $20,000 has been extended to FY 2025.

Here’s a table summary of the Instant Asset write-off thresholds for Small Businesses (under $10 Million per year).

Here’s a table summary of the Instant Asset write-off thresholds for Large Businesses (over $10 Million per year).

Is your Accounting Software up to date? Compare the latest updates on the ATO and Fair Work Rates and Thresholds with the FY 2024 Key Pay Rates & Thresholds.

Disclaimer

This blog and attached resources are of general nature designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.