STP Phase 2 Termination Payments and Other Lump Sums

By Paolo, 01.06.2022

The second phase of Single Touch Payroll also expands the data requirements applicable to Employment Terminations.

Whilst STP Phase 1 only focussed on reporting the different types of Termination Payments for income tax purposes, STP Phase 2 also includes additional information that provides both the ATO and Services Australia with a complete picture of the employee’s cessation.

By including additional information, Services Australia is able to determine the assessable income at termination of employment and to assess the individual’s eligibility to access social security programs such as unemployment benefits.

This new data requirement relieves the employer from having to provide Separation Certificates to the employee at the end of employment, as the employment termination information is submitted electronically to Services Australia through STP.

Additional improvements have also been introduced to other Lump Sum payments including Lump Sum E (pay back payments related to previous Financial Years).

Finally, a new Lump Sum code (Lump Sum W) has also been introduced to identify what the ATO defines as ‘return to work payments’.

STP Phase 2 – Employment Terminations

When dealing with employment terminations, employers will now have to provide two additional fields to the ATO through the STP pay event. These two fields are:

- the cessation date;

- the cessation reason

Cessation Date

The Cessation Date represents the date the employment engagement has ended. The cessation date is different from the resignation date (the date the employee gives notice) or the dismissal date (the date the employer gives notice to the employee), although sometime these dates may coincide.

The Cessation Date must be reported in the STP pay event of the pay period in which the employee ceases their employment.

If additional termination payments are made after such period, the Cessation Date does not have to be updated.

Cessation Reason

When a cessation date is reported in a Pay Event, a Cessation Reason code must also be provided. STP Phase 2 has introduced the following cessation reason codes:

- Voluntary Cessation (V)

This reason code includes resignation, retirement, domestic or pressing necessity and abandonment of employment; - Ill Health (I)

This reason code includes resignation due to medical conditions that prevent the employee from continuing their employment, including total or permanent disability; - Deceased (D)

This reason code includes only terminations of employment due to the death of an employee; - Redundancy (R)

This reason code includes an employer-initiated employment termination due to a Genuine Redundancy or approved Early Retirement Scheme; - Dismissal (F)

This reason code includes an employer-initiated employment termination due to lack of performance, inefficiency or misconduct; - Contract Cessation (C)

This reason code includes the natural conclusion of an employment relationship due to a contract/engagement duration, seasonal work, task completion and finally casual employment, no longer required; - Transfer (T)

This reason code includes the transfer of employment across two entities that are part of the same Employment Group or the transfer of employment from/to an outsourcing Agency.

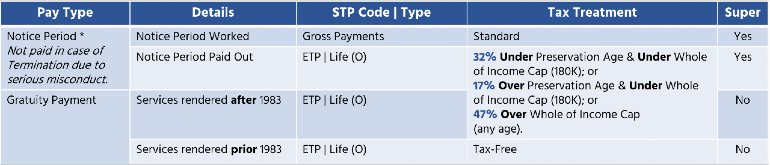

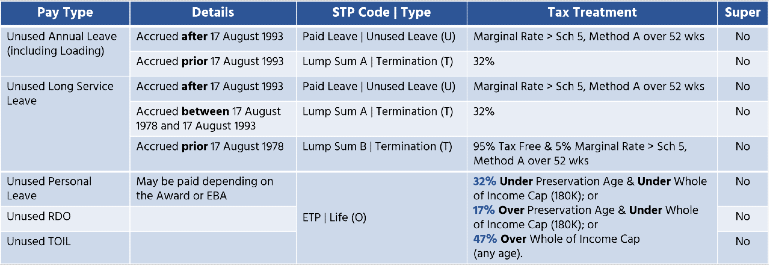

Termination Payments

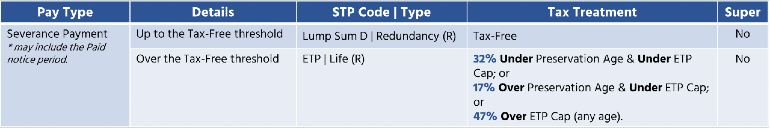

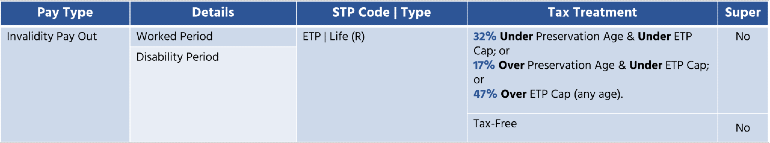

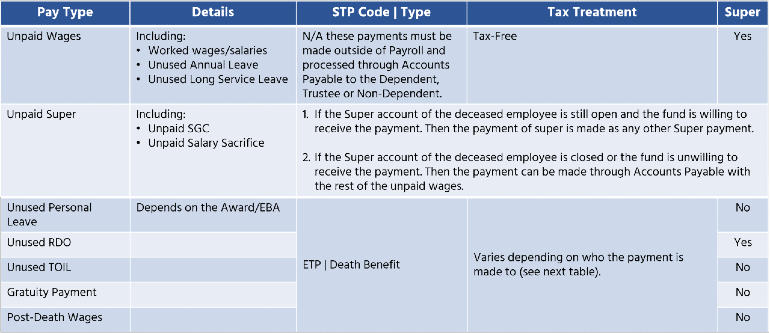

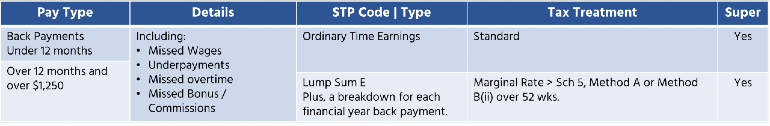

The STP Codes assigned to Termination Payments have not changed from STP Phase 1 to STP Phase 2. The following tables provide a summary of the STP Categories applicable to termination payments:

Payment in Lieu of Notice and Gratuity Payments

Unused Leave

Genuine Redundancy and Approved Early Retirement Scheme

Total and Permanent Disability

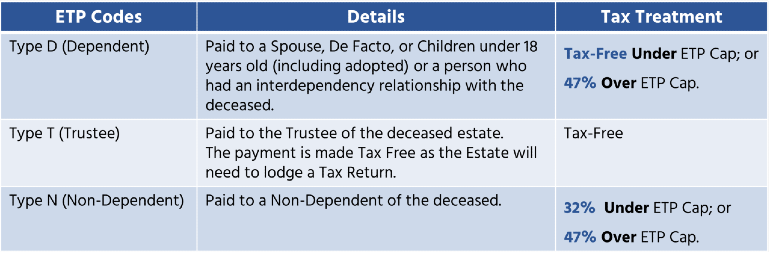

Payments for the death of an employee

As employment termination is a core part of payroll, very few termination payments fall out of scope and are therefore excluded from STP reporting. The only payments excluded from STP are any unpaid wages, entitlements and Superannuation for a deceased employee. These payments are generally paid to the descendant via accounts payable and are not taxed.

However, if any additional payments are made to the employee’s descendant, these payments must be processed through payroll by creating a new Employee record with the details of such descendant and taxed accordingly.

Death of an Employee and Payments to a Deceased Estate

ETP Payments made to descendants

STP Phase 2 – Other Lump Sum Payments

Lump Sum E Payments

In STP Phase 2 the ATO has also improved the reporting capability applicable to Lump Sum E payments.

A Lum Sum E payment is a back payment of more than $1,200 that relates to payment periods 12 months or older from the date the back payment is made.

Prior to STP Phase 2, an employer was also required to provide a letter to their employee identifying the correct Financial Year(s) to which the back payments were related. The employee had to provide this letter to their Accountant so their previous Tax Return(s) could be amended.

When reporting Lump Sum E payments in STP Phase 2, employers are now required to specify the Financial Year(s) to which the back payments relate and include this information as part of the STP pay event. This new requirement will eliminate the need to issue a manual letter to the employee.

Back Payments

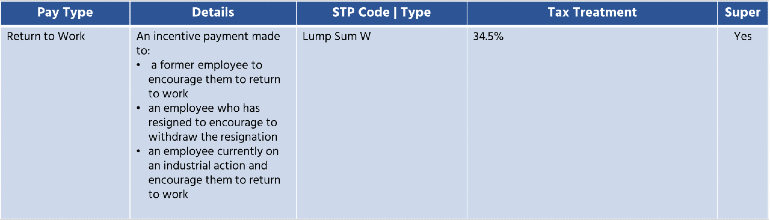

Lump Sum W Payments

When scoping STP Phase 2 requirements, the ATO also realised that at times, the termination of employment does not necessarily represent the end of the relationship between the employee and employer.

The ATO has identified a range of Payments defined as ‘Return to Work payments’ and has introduced a new Lump Sum code to identify such payments: Lump Sum W.

Lump Sum W payments include incentive payments made to:

- a former employee to encourage them to return to work;

- an employee who has resigned to encourage them to withdraw their resignation; and finally

- an employee currently on industrial action to encourage them to cease such action and return to work.

Lump Sum W payments are subject to a fixed 34.5% Tax Withholding and attract Superannuation.

Return to Work Payments

Conclusions

Employment Termination represents one of the most complex payroll tasks. Single Touch Payroll simply brought this complexity to the surface.

Employers should treat these payments very carefully as the tax calculation on these payments can have a severe impact on the employee’s tax return.

Although STP Phase 2 will relieve the employer from manual reporting requirements like Separation Certificates, this area still remains one of the most complex payroll components and requires in-depth knowledge of both tax and payroll legislation.

Small and Medium business employers should consider delegating this task to an expert.

References

Disclaimer

This blog and attached resources are of general nature designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.