Understanding ATO Tax Debts and Payment Plans

By Paolo, 10.01.2024

At the start of the 2010 decade, the ATO estimated the outstanding tax and superannuation debt owed by Australian businesses to be around $23 billion.

In response to the increasing debt problem, the ATO planned to restructure its administrative arrangements for the management of debt by introducing a number of new technologies to increase the visibility of outstanding tax liabilities and reduce the national tax debt.

Over the course of the last decade, the ATO implemented a number of key technologies that helped streamline the flow of data between Australian businesses and the Taxation Office. The most notable are:

- Superstream (2014-2015)

Supestream changed the way businesses pay superannuation contributions to super funds. With SuperStream, payments and data are sent electronically in a standard format between businesses and super funds. - Single Touch Payroll Phase 1 (2017-2019)

Single Touch Payroll streamlined the payroll data between employers, the Tax Office and Superfunds. With Single Touch Payroll, employers report payroll data electronically to the ATO on each pay date. Furthermore, super funds must electronically notify the ATO within 48 hours of employers making superannuation payments.

By the end of the 2019-2020 Financial Year, the ATO expected to have full transparency and visibility of the current tax debt for Australian businesses and start debt collection proceedings on Australian businesses based on the data received.

However, 2020 turned out quite differently. bushfires, the COVID-19 pandemic and floods deeply affected both lives and livelihoods of all Australians.

The Tax Office realised its primary role during the first two years of the 2020 decade was to support Australian businesses and provide a safety net to ensure as many as possible survived the economic crisis.

During this time, the ATO:

- provided a range of financial support options to assist businesses impacted by COVID and natural disasters;

- introduced payment deferrals and interest-free payments applicable to all ATO tax debts (excluding Superannuation);

- waived general interest charged on current payment plans and secured all new payment plans as interest-free;

- completely stopped any debt recovery action, and finally

- applied a moratorium on statutory demands for company administrations and liquidations.

This strategy, which was essential to support all Australian businesses in great financial distress, caused an increase in the public outstanding tax debt to over $50 billion.

With businesses in the process of recovering from COVID and natural disasters and the national economy settling down again, the ATO has reprised their debt recovery proceeding.

From June 2022, the Tax Office has already sent a high volume of:

- payment reminder letters;

- garnishee orders;

- creditor warnings and

- Director Penalty Notices.

This blog article is the first of a two-part series designed to help small businesses understand ATO debts, how to manage them effectively and the consequences for businesses and their owners to ignore them.

This article focuses on what an ATO debt is and the various options to pay it, including how to set up and manage payment plans.

What is an ATO Debt?

Depending on their size and type, Australian Businesses are required to report and pay various tax obligations to the ATO.

These are:

GST (Goods and Services Tax) – reported monthly or quarterly to the ATO as part of the Business Activity Statement;

PAYG Withholding – this is the tax withheld from the employee’s pays, also reported monthly or quarterly as part of the Business Activity Statement;

WET (Wine Equalisation Tax) – reported by wine produces and wholesalers as part of the Business Activity Statement;

LCT (Luxury Car Tax) – reported by car manufacturers and dealerships as part of the Business Activity Statement;

Company Income Tax – reported annually by Companies (Pty Ltd) to the ATO by lodging an Income Tax return;

PAYG Instalment – after lodging the first positive Income Tax return, the ATO requires 1/4 of the business income tax paid the previous Financial Year to be paid in advance as an estimate of the Income Tax for the current year. This is reported quarterly as part of the Business Activity Statement;

Fringe Benefits Tax – reported annually to the ATO by lodging an FBT Tax return;

FBT Instalment – after lodging the first FBT return, the ATO requires 1/4 of the FBT paid the previous FBT Year to be paid in advance as an estimate of the FBT for the current year. This is reported quarterly as part of the Business Activity Statement;

Superannuation – Businesses are required to pay Superannuation directly to their employees’ super funds via a Clearing House.

However, the Superannuation liability must be paid directly to the ATO when Superannuation is not paid or paid late. In this instance, businesses must lodge a Superannuation Charge Statement for every quarter their superannuation is not paid or paid late to the ATO.

Once a business (or its Tax Agent) lodges any of the above tax returns, the ATO shows a debt in one of the following ATO accounts:

Integrated Client Account (or Activity Statement Account) – this is the ATO account that manages all lodgements and payments of the business’ Activity Statements

Income Tax Account – this is the ATO account that manages all lodgements and payments of company Income Tax lodgements;

Fringe Benefits Tax Account – this is the ATO account that manages all lodgements and payments of FBT lodgements;

Superannuation Employer Account – this is the ATO account that manages all lodgements and payments of Superannuation Charge Statements.

In principle, an ATO account works the same way as a loan account from a bank. The tax lodgement is the equivalent of a loan payable amount. Payments to the account decrease the outstanding debt, and when applicable, interest, interest remissions, and other charges affect the account’s balance.

For instance, when payments for Activity Statements are made, the payment details are always the same for a business, as all Activity Statements are managed in the one Integrated Client Account. The payment is never allocated specifically to one Activity Statement. It just reduces the current balance of the ATO account.

| Example 1 ABC Constructions lodges their Apr-Jun Activity Statement for $60,000 through their Tax Agent. They have until the 25th of August to pay this debt. At the start of August, they also lodge their monthly PAYG Withholding for an additional $15,000, which is due by the 21st of August. ABC Constructions can simply make one lump sum payment of $75,000 as the payment details for all of ABC Constructions’ Activity Statements are the same. |

How to pay an ATO Debt

The ATO requires all businesses to pay their tax debts in full by the due date.

The due date of a Tax Lodgement applies to both lodgment and payment. However, this does not mean lodgement and payment must happen at the same time. A business may lodge a tax return weeks or even months in advance without having to pay it before the due date.

The ATO accepts all payment methods, including Bpay, bank transfer and credit card. It also allows the transfer of existing tax credits from one account to reduce the debt in another.

| Example 2 ABC Constructions recently lodged its Income Tax Return for FY 2022. As the payable income tax in FY 2021 was $80,000, the company had to advance $80,000 as PAYG Instalments in their FY 2022 Activity Statements. However, the Income Tax for FY 2022 turned out to be less than the previous year ($50,000). As a result of the reduced Income Tax for FY 2022, the Income Tax Account shows a credit of $30,000 in prepaid income tax. Instead of paying their $60,000 Apr-Jun BAS out of their pocket, the Tax Agent transfers the $30,000 credit from the company Income Tax Account to the Integrated Client Account, reducing the debt balance of the Apr-Jun BAS from $60,000 to $30,000. |

When the lodgement of a tax return happens earlier than the due date, the business can also choose to make part payments towards the amount payable without notifying the ATO or being charged interest.

| Example 3 ABC Constructions lodged their first positive Tax Return in FY 2021. An income tax liability of $80,000 was lodged in early October 2021. The Tax Agent informed his client that the full amount of Income Tax had to be paid by May 15, 2022. Starting from October 2021, ABC Constructions decided to pay $10,000 per month towards their Income Tax debt to ease their cash flow. The Tax Agent confirms that, as the full balance will be paid by the due date, the ATO does not need to be notified of this decision. |

However, the ATO must be contacted, and proper arrangements have to be made when the Business does not have the financial resources to pay its tax liabilities by the due date. The first step in this arrangement is to agree to a Payment Plan.

What is an ATO Payment Plan?

A payment plan is a formal payment arrangement between a business and the Australian Taxation Office. It allows a business to pay back its tax debt across a number of instalments for a maximum of 2 years.

Instalments can be agreed to be paid weekly, fortnightly or monthly. Payments can be made by Bpay, bank transfers, credit card and direct debit.

The business can choose to include either the full debt owed in the relevant ATO account or just the outstanding component of it. However, the payment plan cannot include future tax debts that have not yet been lodged.

General Interest Charges (GIC) apply to most ATO Payment Plans. When the payment plan is approved, the estimate of the GIC payable is provided. This is reduced if the business makes additional voluntary payments or settles the payment plan earlier.

GIC is calculated on a daily compounding basis on the outstanding tax amount. GIC annual and daily rates are available on the ATO website.

Interest-free Payment Plans

The ATO allows interest-free payment plans of up to $50,000 to businesses that meet the following conditions:

- have an annual turnover of up to $2 million;

- can demonstrate ongoing payment viability;

- agree to a payment plan of no longer than 12 months;

- have a good payment and lodgment history with the ATO, including:

- no more than one payment plan default within the previous 12 months;

- no outstanding Activity Statement lodgements;

Interest-free payment plans are only available for the Integrated Client Account (Activity Statements).

Terms & Conditions

Payment plans are formal; this means that the ATO requires the business to agree to specific terms and conditions prior to approving the payment arrangement.

The most crucial conditions for a business to be aware of are:

- at least 10% of the payment plan must be paid within 14 days from the application date;

- instalment payments must reach the ATO account no later than the agreed instalment pay date;

- instalment payments can be higher than the agreed instalment amount or happen more frequently, but cannot be of a lesser value or less frequently than the agreement;

- the payment plan never waves the lodgment and payment obligations applicable to future tax returns;

- the payment plan can be settled at any time prior to its expiration date.

The payment plan is allocated to the ATO account carrying the tax debt at the time. It cannot be transferred to a different ATO account.

When a business has more than one outstanding debt across multiple ATO accounts, a payment plan for each ATO account must be arranged at the same time.

It is extremely important for Businesses to understand that they should never leave an outstanding tax debt with the ATO, even if they intend to pay it within a short timeframe.

An active Payment Plan protects the business from the ATO being able to take further legal action against the company or the company’s Director and issue garnishee orders, creditor warnings or Director Penalty Notices.

How to set up a Payment Plan with the ATO

There are two ways to organise a payment plan:

- Online via Online Services for Business or Agents

- By contacting the ATO on 13 28 66 (fast key code 2 2)

Monday to Friday from 8:00 am to 6:00 pm

Note: Company ABN must be keyed in as part of the identity verification process

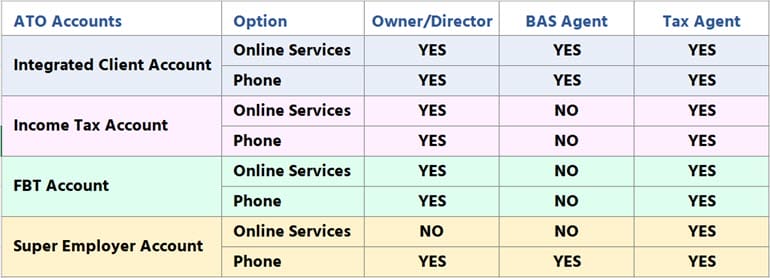

Payment Plans can be organised by the Business Owner/Director, the business’ BAS Agent or the Tax Agent (Accountant). However, restrictions apply across ATO accounts.

Summary of the ability to apply for payment plans for Directors, BAS agents, and Tax agents for different ATO accounts.

Online Applications

Online Payment Plan applications are limited to tax debts of up to $200,000.

When applying online, the ATO will request the following information:

- the initial payment of at least 10% of the debt amount within 14 days from the application date;

- the choice of instalment amount and frequency.

The online application is either immediately approved or rejected.

When the application is approved, a green Payment Plan tag will be displayed next to the account on the ATO Portal.

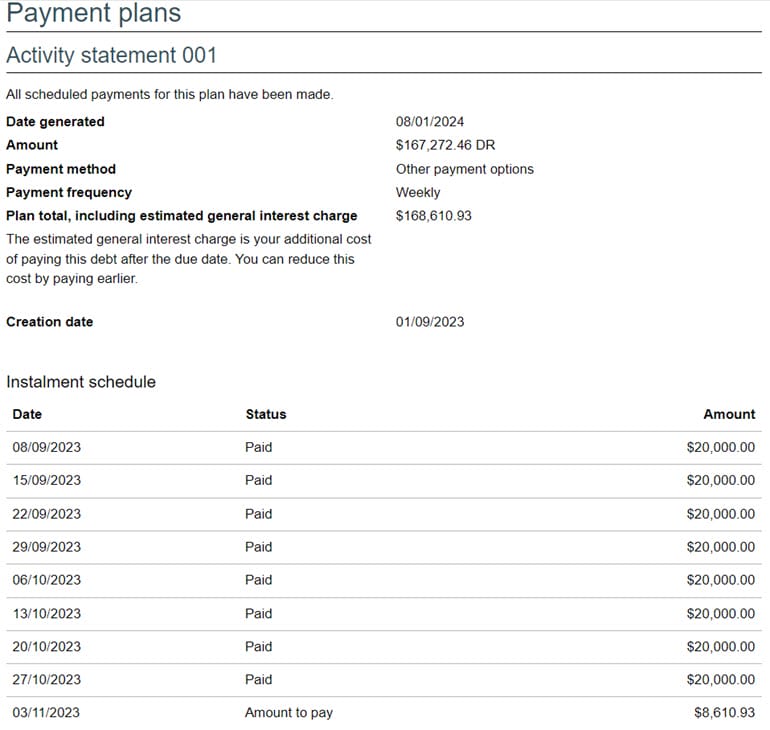

A summary of the Payment Plan, including the schedule of payment and the total estimated GIC, is also available for download from the ATO Portal.

Sample of the Payment Plan confirmation summary.

When rejected, the ATO Portal will request the user to contact the Tax Office directly.

The ATO automatically rejects online applications in the following instances:

- where the amount is over $200,000;

- where another ATO account also has an outstanding debt;

- where the business has had two or more payment plans defaulting within the previous 12 months;

Phone Applications

Over the phone, the Tax Office will first check the business lodgment and payment history with the ATO. Depending on such history, the ATO operator may ask a range of questions and request specific information to assess the business viability of paying the debt.

The application is generally straightforward for businesses with a good payment history. The ATO operator will simply request the same core information as the application online.

However, when the business has a previous history of consistently defaulting on payment plans, the application is escalated to the ATO Enforcement Division.

This department may require the provision of key financial information and agreement to stricter conditions, such as:

- agreeing to pay the instalments by a Direct Debit arrangement controlled by the ATO;

- requesting a summary of the revenue recorded for previous periods (months, quarters or years);

- requesting a summary of the expenses for previous periods;

- requesting a summary of the current Assets and Liabilities.

The more defaulted payment plans, the more information the ATO requires to approve the next payment arrangement and the higher the risk of future legal action in case the debt remains unpaid.

Businesses should try to avoid defaulting on ATO Payment Plans at all costs.

| Summary of the Financial Information requested by the ATO Enforcement Division to approve a payment plan. | |

| Revenue Analysis | |

|

|

| Expense Analysis | |

|

|

| Asset & Liability Analysis | |

|

|

| Business Repayments | |

|

|

How can a Payment Plan default?

A payment plan defaults when the business fails to make the instalment payments or when the instalments are paid after the due date.

When making instalment payments, businesses should always submit the payments at least 2 business days prior to the instalment due date to allow enough time for the ATO to receive the payment and allocate it to the relevant ATO account.

To avoid arrear payments and possible defaults, Businesses should opt to use a Direct Debit arrangement. This guarantees the instalments will always be paid on time and avoid payment plans from defaulting.

Although this seems quite straightforward, businesses should be aware of other risky circumstances where a payment plan may default. At the core of these situations is the important provision that future debts cannot be included in the current payment plan.

To work out why a payment plan may default when other tax debts are lodged, it is important to understand how the payment plan interacts with future tax lodgements.

When the ATO sets out a payment plan, it sets an expectation for the running balance of the account to be a certain amount by the instalment due date.

If the running balance on the due date is the expected amount or less, the Payment Plan remains active. However, if the running balance of the account is higher than the amount set out by the ATO, the Payment Plan automatically defaults.

| Example 4 ABC Constructions lodges their Jul-Sep Activity Statement for $50,000 via their Tax Agent. They have until the 25th of November to pay this debt. Unfortunately, the business key projects suffered some unexpected delays, and the company is having some cash flow issues. ABC Constructions asks their Tax Agent to organise a $10,000 monthly Payment Plan payable by the 23rd of each month starting from the 23rd of October. The ATO Integrated Client account is currently in debt by $50,000. As the business’ annual turnover is less than $2 million and the payment plan does not exceed $50,000, no GIC applies. Based on the payment plan, the ATO sets the following expectations for the account running balance:

ABC Constructions makes the first $10,000 payment by the 23rd of October, reducing the running balance of the account to $40,000. On the 5th of November, ABC Constructions lodges the November PAYG Withholding instalment for $7,500. This amount is payable by the 21st of November. The running balance of the Integrated Client Account increases to $47,500. ABC Constructions pays the $10,000 instalment of their payment plan on time by the 23rd of November. However, they fail to pay $7,500 of the November PAYGW Instalment by the due date (21st of November). On the 23rd of November, the running balance of the Integrated Client Account is $37,500. As the ATO expects the balance on the account to be $30,000 as of this date, the Payment Plan automatically defaults. |

How to change, extend or renew a Payment Plan

The ability to change a payment plan is limited to:

- modify the payment method (for example, from manual payment to direct debit);

- update the direct debit payment option (for example, changing from a bank account to a credit card);

- change the instalment due date

Note: businesses must notify the ATO of their intention to change the payment due date by no later than 2 working days before the payment is due; - extend the payment plan by decreasing the value of the periodic instalments (providing the original length of the payment plan was less than 2 years).

A Payment Plan can never be extended to include future tax debts. However, the ATO can cancel the current plan and schedule a new one that includes the new tax debt.

This is considered a brand-new Payment Plan application subject to the same scrutiny and Terms and Conditions as the original plan. The voluntary cancellation of a Payment Plan for a new plan to include additional tax debts does not count as a default.

Businesses that struggle to pay new tax obligations should contact the ATO and organise a new plan rather than cause the existing one to default.

Tax Debt Forgiveness and Remission

Tax debt forgiveness is when the ATO decides to waive all or part of an outstanding tax debt.

There are two types of debt waving:

- Debt remission > This applies to the reversal of General Interest Charges or late lodgement fees charged by the ATO for late payments, lodgements or as part of a payment plan;

- Debt forgiveness > This is when the ATO decides to waive the principal component of the debt as well as any applied interest.

Debt Remission

General Interest Charges apply in the following circumstances:

- When a business pays the tax obligation after the due date. The GIC amount calculation is based on the number of days between the due date and the late payment date.

All interest charges under $50 are automatically remitted by the ATO.

Occasionally, higher interest charges are also remitted by the ATO without a specific request. This depends on the business size and payment history with the ATO. - When a business agrees to a Payment Plan with the ATO.

Interest on payment plans is never remitted automatically or voluntarily by the ATO.

Businesses can contact the ATO, and request to have their General Interest Charges or Late Lodgement fees remitted. Agents from the Tax Office have some leeway to approve the remission request directly.

In some instances, the Operator will inform the Business that such a request requires escalation and will ask to submit it in writing. Formal remission requests can take up to a minimum of 28 days before being reviewed. The Tax Office will confer their decision in writing either by confirming their decision to either approve or deny the request.

Credit Interest

Occasionally, the ATO may reward a business by crediting some interest in one of the ATO accounts as the company paid a tax liability months prior to its due date. Generally, this only happens with Company Income Tax, where a business has nearly 12 months from the end of the previous Financial Year to lodge and pay.

Debt Forgiveness

Debt forgiveness only applies to individual taxpayers, Sole Traders and Trustees of a deceased estate.

Companies, Trusts and Partnerships cannot apply to have tax debts forgiven unless they are going through mandatory or voluntary liquidation.

| Types of tax debts that can be forgiven | Types of tax debts that cannot be forgiven |

|

|

The ATO will consider forgiving a tax debt when a person is facing “serious hardship”. Many situations can contribute to serious hardship, including family tragedy, financial misfortune, mental health challenges or impacts of natural disasters.

The ATO considers hardship to exist where the payment of a tax liability would result in a person being left without the means to afford basics such as food, clothing, medical supplies, accommodation or reasonable education. The test is to establish whether the result of paying the tax would be so burdensome that the person would be deprived of what are considered necessities according to normal community standards.

The individual must provide evidence they are experiencing serious hardships as part of the application (i.e. eviction notices, notice of legal actions, overdrafts, overdue bills, etc).

The ATO provides a Debt release online tool to help individuals determine if they are eligible to apply for a debt release.

Before the ATO can consider the Debt forgiveness application, the following conditions must be met:

- all outstanding tax returns must be lodged;

- contact details must be up to date on the ATO portals;

- any previous unresolved disputes must be settled first;

- any unresolved compensation, damages or insurance claim must be finalised first.

More information on applications for debt forgiveness can be obtained by contacting the ATO on 13 11 42.

Key Takeaways and Tips for Business Owners

ATO debts apply to businesses when a Tax Return is lodged with the Tax Office.

The debt is managed in the relevant ATO account together with previous and future debts from similar tax lodgements.

Businesses are encouraged to pay all their tax debts on time by the due date. However, if a business is struggling financially to meet a payment deadline, such a business should contact the ATO and organise a Payment Plan.

Once a payment plan is active, the business should be aware of the following:

- all instalment payments must be paid by the due date, or the Payment Plan will default.

The more times a business defaults on a Payment Plan, the stricter the ATO will be in approving future payment plans and conceding interest and penalty remissions. - General Interest Charges may apply.

The longer the payment plan, the more interest the business will have to pay.

Therefore, when a business is thinking about setting up a payment plan, it should consider:

- making sure that it can honour the commitment to pay the periodical instalments;

- budgeting for the additional costs (interest charges), and offset these costs against the ability to pay the debt in full by the due date;

- paying all future tax debts and payment obligations in full by the due date.

Businesses can use the ATO online payment plan estimator to assess what instalment amounts they can afford and the total interest costs prior to contacting the Tax Office.

Tax Debts and Payment Plans should not be taken lightly by businesses. Ignoring a debt or continuously defaulting on payment plans may have serious consequences impacting not just the business’ creditors’ reputation, cash flow and other assets but also putting the Director’s personal investments at risk.

References

https://www.ato.gov.au/individuals-and-families/paying-the-ato/help-with-paying

https://www.ato.gov.au/newsrooms/small-business-newsroom/when-should-you-enter-into-a-payment-plan

https://www.ato.gov.au/calculators-and-tools/payments-payment-plan-estimator

https://www.ato.gov.au/individuals-and-families/paying-the-ato/help-with-paying/payment-plans