13 New Reports Features Xero Released in the Last 12 Months

By Paolo, 10.06.2023

On 19 July 2022, Xero announced that the “Old Version” of their report suite would retire on 31 July 2023 and be replaced with their “New Version” Reports, which were first introduced in July 2016.

By July 2023, Xero would have supported two separate reporting technology within their platform for 7 years. Although this may come across as a poor and confusing approach to a core Accounting feature, developing a new report suite is not as easy as many may think.

Furthermore, Xero (like many Accounting Businesses) has been very busy dealing with COVID Grants, major Payroll upgrades (STP1 and STP2) and rolling over a full facelift of their platform. All these additional requirements have probably slowed down the original transition plan.

The news of the retirement of the “old guard” reports has spiked up a lot of resistance, particularly from Accounts Professionals who always favoured the old versions of the Xero reports. In all honesty, at the time of the announcement, Xero had a lot of ground to cover before the New Reports could fully replace the old version. It’s probably quite reasonable to expect a bit of panic when the new platform was not yet ready to accommodate the users’ needs.

However, during the Announcement, Xero assured its subscribers that in the coming 12 months, they would have worked hard to implement a range of new features into the new reports and facilitate the transition. A year later, and a few weeks from the retirement date, Xero has made good on its promise. In the last 12 months, we have seen a number of new features being implemented in the new reports. We have decided to bring them all together in this blog to help you with the upcoming transition.

With a few weeks left before the retirement date, it’s important for all businesses that still use the Old Reports to start transitioning to the New Reports before it’s too late.

Should they stay, or should they go?

First and foremost, we’ll answer some of the most common questions we have seen coming up on various online platforms about the retirement of old reports.

How do we know which of the reports is “old” and going to retire?

Xero displays a Yellow tag Old version retires 31 Jul next to any report that is going to disappear in July 2023. If you are currently using any of these reports in your business, you should search for an equivalent report available within the new version.

Are all the “old reports ” going to retire by the 31st of July?

The short answer to this question is no. Unless one of the “New Reports” can provide either the same or similar information to replace the old report, the previous version will still be available.

Early days, Xero confirmed that the old Activity Statement and GST Reconciliation reports (a favourite of both Bookkeepers and Accountants) were going to continue to be available after July 2023. Their replacement is going to be part of a larger plan to launch an improved BAS reconciliation and reporting experience.

In addition, Xero will also retain the following “Old Reports” after July 2023:

- Budget Manager report;

- Budget Summary report;

- Expense Claim Summary report;

- Foreign Currency Gains and Losses report;

- Realised Gains and Losses report;

- Unrealised Gains and Losses report;

- Inventory Item Summary report;

- Sales by Item Summary report;

- Tracking Summary report.

What will happen to the old custom reports?

Any “old version” reports saved as custom reports will be removed from Xero. The same applies to any “old reports” saved as Drafts.

What will happen to the old report packs available to Accountants and Bookkeepers in Xero HQ?

The old Xero HQ report packs will no longer be available either in Xero HQ or within the Client’s Xero Organisation.

What will happen to old published reports?

Any old published report will still be accessible. However, the ability to Copy & Edit the Published reports will be removed.

The same applies to the published Xero HQ reports. These will be available as read-only within the Client’s Xero Organisation.

Do we need to recreate all the old custom reports using the new reports?

Yes. However, Xero has created a pretty clever tool to facilitate this process, helping you create a New Custom Report directly from the previous version.

Are Payroll reports considered old reports or new reports?

Neither, as Xero Payroll is an independent module from the rest of Xero, all Xero Payroll Reports are not impacted by this transition.

13 New Reports Features Released in the Last 12 Months

As promised, here’s a list of the 13 core features introduced in New Reports since Xero’s Announcement to retire the old reports.

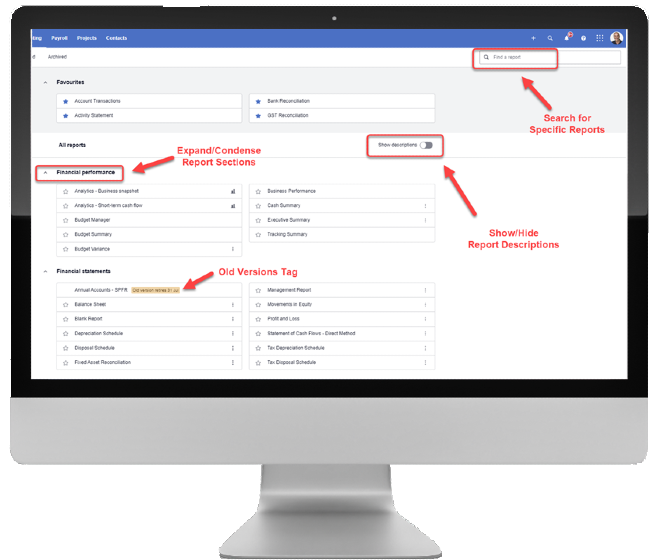

1 The new Report Centre

As a starting point, Xero has refreshed the look and feel of the Report Centre. The new look is designed to allow you to easily search and organise your reports. Standard Reports have been grouped in a more logical order. Favourite Reports now appear in their own section, placed neatly on the top of the screen.

The refreshed screen is more interactive. It includes the ability to expand and condense report sections, to show or hide report descriptions and finally, an enhanced search functionality that allows you to look for reports by title, keyword or description.

Whenever a new report has been designed to replace one of the old reports, only the new report is shown in the Report Centre.

The equivalent old report version can be found either by using the search feature (and it will display an Old Report Tag next to its name) or by clicking on the overflown menu next to the new report. These options will formally disappear once the old reports retire on 31 July 2023.

Two new Side Panels are also included in popular reports:

- a tips and tricks panel that showcases both user guides and training videos; and

- a report suggestion panel that provides a list of standard and common format custom reports similar to the report you are currently running.

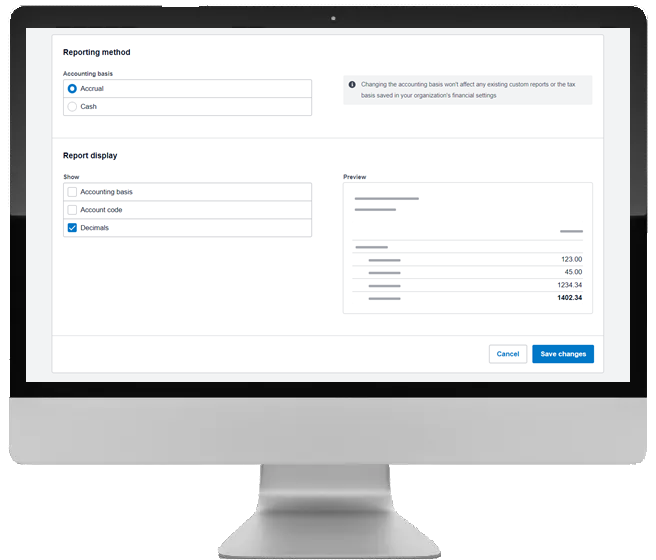

2. Reports Global Preferences

Xero has also released a new Global Reporting Preferences feature which will allow you to set default options across all your reports. Global Report Preferences include:

- Default Accounting Basis (Cash or Accruals) to run reports;

- Show/hide Accounting Basis;

- Show/hide Accounts Codes;

- Show/hide cents.

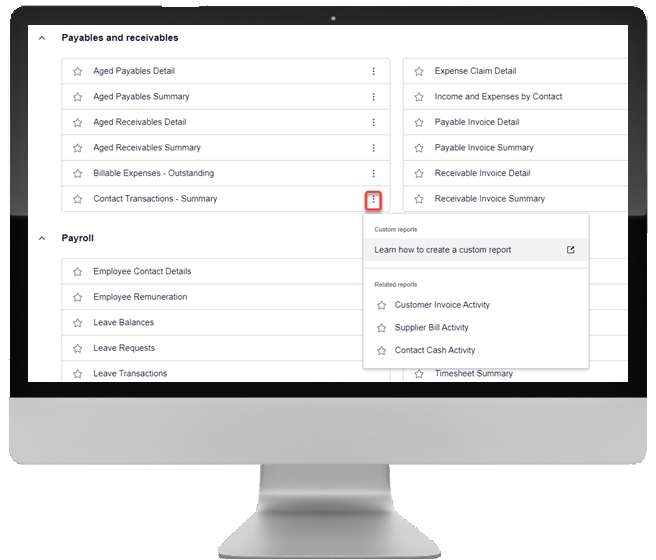

3. Pre-Custom Common Format Reports

The ability to customise reports has always been the key feature of the New Reports. Now Xero has also cleverly included a few hidden “gems” in each report by providing a range of pre-custom common format reports.

Click on the overflow menu next to the report to find a quick list of pre-custom common format reports, as well as other custom reports.

You can access these common format reports and quickly set them as a favourite. Alternatively, you can further customise the common formats and save them as new custom versions.

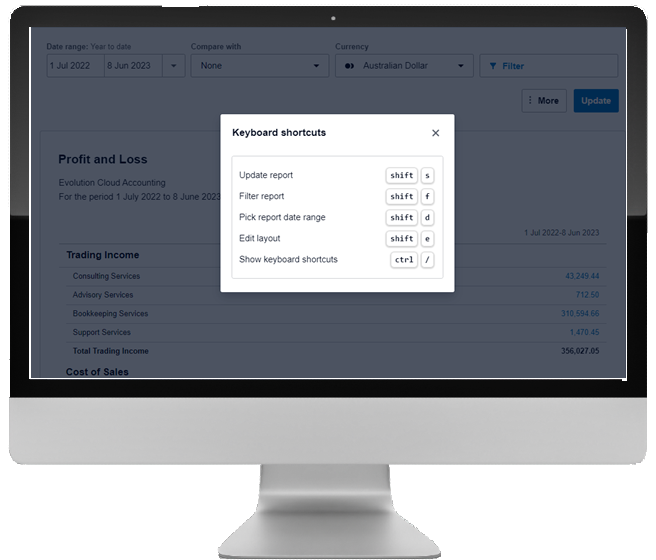

4. Keyboard Shortcuts

One for all the keyboard aficionados, you can now use Keyboard Shortcuts to navigate Xero’s New Reports.

First, the new shortcut Ctrl + / has been created. This shortcut displays a quick pop-up menu listing all the keyboard hotkeys developed for Xero Reports. Other Keyboard Shortcuts will allow you to update and filter reports, select date ranges or access the report’s Layout Editor.

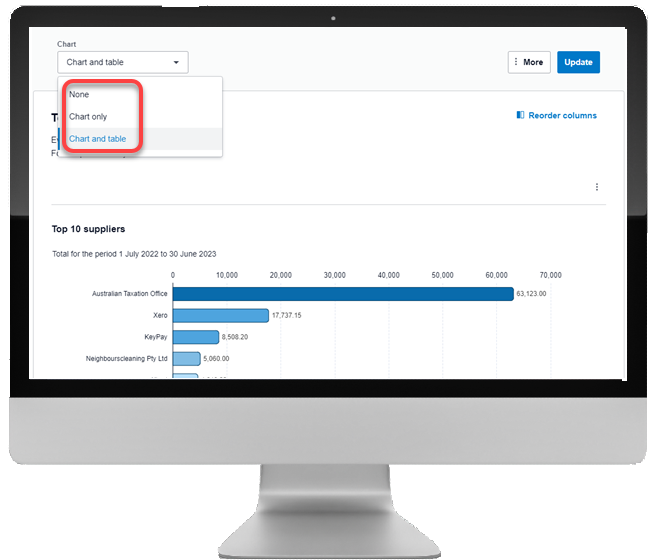

5 Report Charts (Beta)

The following pilot reports now include charts.

- Top Customers and Top Suppliers;

- Income by Contact and Expenses by Contact.

This is a beta trial that will hopefully expand across other Xero reports in the near future.

When you run these reports, you will be presented with the option to run:

- the data table;

- chart and data; or

- chart only.

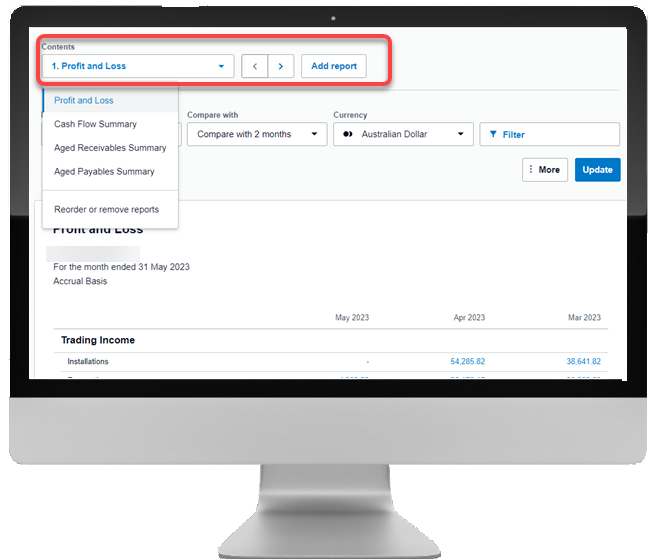

6 Report Packs

You can now create your own Report Packs and save them as Custom Favourites. Report Packs allow you to combine a number of reports together, saving you time whenever you need to run these reports.

This is an amazing feature that will allow you to create customised Management Reports or combine key audit reports for reconciliation tasks. You can add both standard and custom reports to a Report Pack (except for Payroll Reports), making the pack look exactly as you want it to.

This is definitely one of our favourite features. We used to manually create a Management Report pack for all our clients as part of our BAS work. We had to run each report individually, export them to PDF and then combine them using PDF Editor. Now we simply run the one Report Pack that includes everything we need.

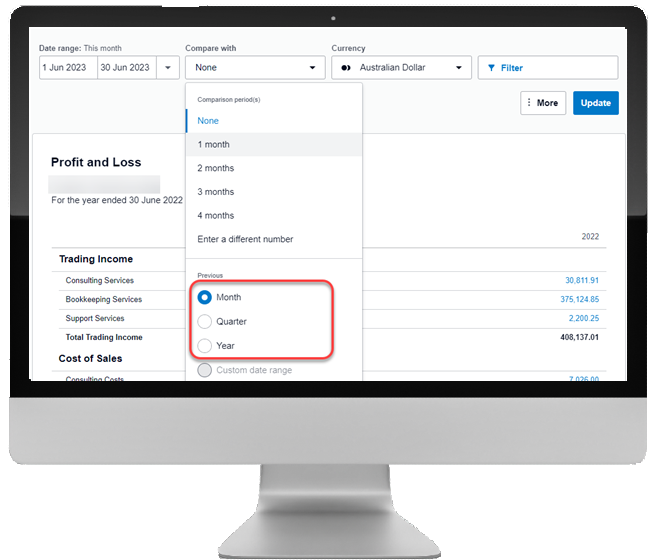

7. Comparison Periods

One of the main points of resistance for many Accounts professionals in transitioning to New Reports was the many issues found when comparing periods.

When prompted to compare multiple periods, Xero’s New Reports often got confused. Sometimes the monthly period only included data for 30 days instead of the full month (missing the last day of any 31-day month). Other times the report displayed random periods (i.e. 1st March – 30 March, 31 March – 29 April etc.). This was a major issue only fixable by going into the Layout Editor and manually updating the period dates.

Xero finally fixed this bug, allowing you to choose the correct comparison period. You can now select Month, Quarter or Year comparison periods within a wide range of reports.

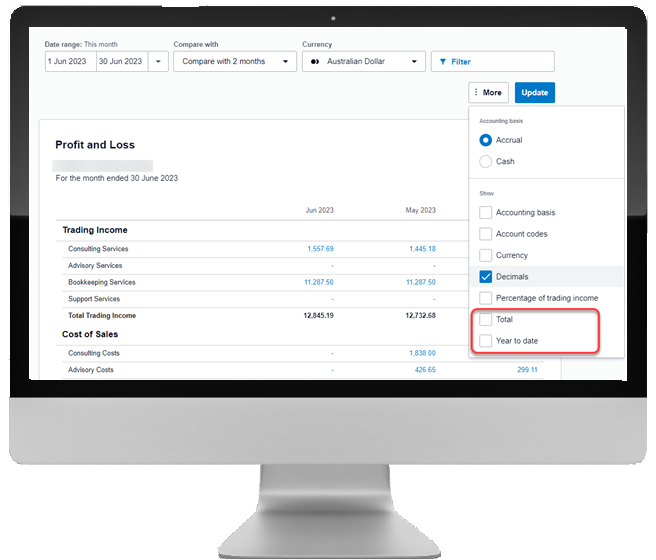

8. Formula Columns

Another key feature of New Reports is the ability to create Formula rows and columns in the Layout Editor. The report formulas work similarly to Microsoft Excel’s formulas. You can total or average different periods and even calculate percentages.

Naturally, the most commonly used report formula was calculating the period totals. Xero has now included both the Period and YTD Total formulas as part of the standard report options. This means you no longer have to manually create a Total column for your reports in the Layout Editor. You can simply switch on and off additional Total and/or YTD Total columns from the More overflow menu.

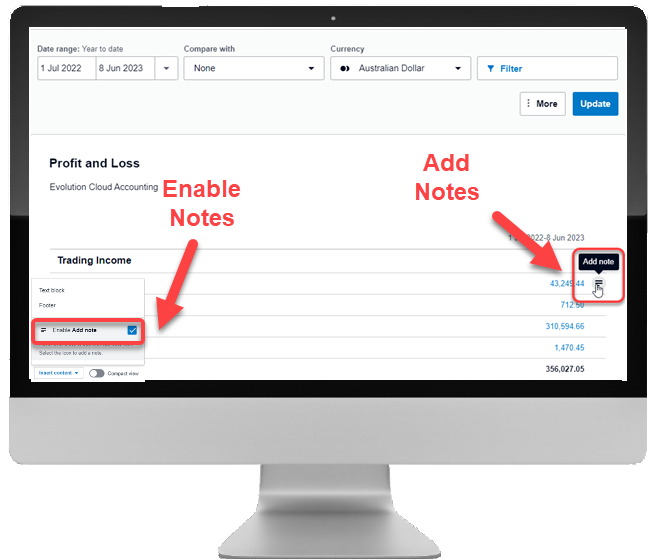

9. Report Annotations

The ability to make annotations to reports was a very popular request, particularly by Accounts Professionals. This feature was heavily used in old reports and is now available in New Reports.

Report annotations can be used in conjunction with footers, text blocks and schedules to add commentary to the numbers.

Report Annotations must first be enabled in the report. Once enabled, they can be added next to any text or values appearing on the report, and the notes will appear on the footer of the report. This will help share explanations between your Advisor, Bookkeeper and you to make sense of report numbers.

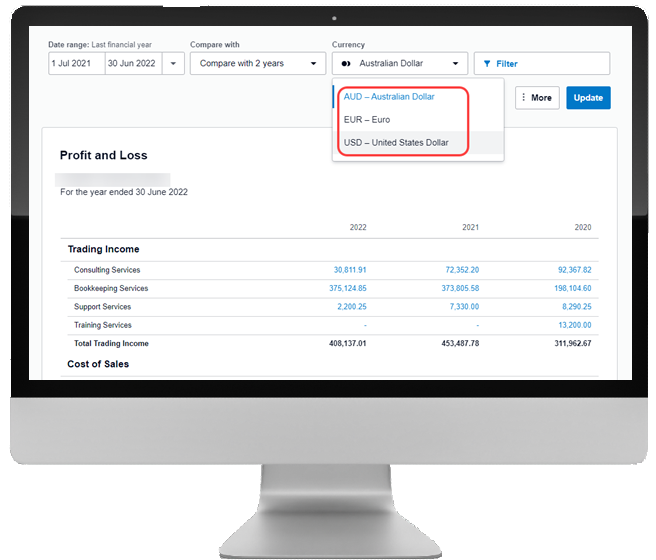

10. Multi-Currency

Xero added the ability to translate reports into any of the Foreign Currencies enabled in the Client’s Organisation.

Report Multi-Currency features include the ability to:

- see transactions in the original currency to help you get better insights into international sales and purchases;

- see the foreign currency conversion and the Organisation’s base currency side-by-side;

- filter, group and sort data by currency.

Multi-currency is available on the following reports:

- Profit & Loss;

- Balance Sheet;

- Receivable and Payable Invoice Summary and Detail;

- Income and Expenses by Contact; and

- Budget Variance Reports.

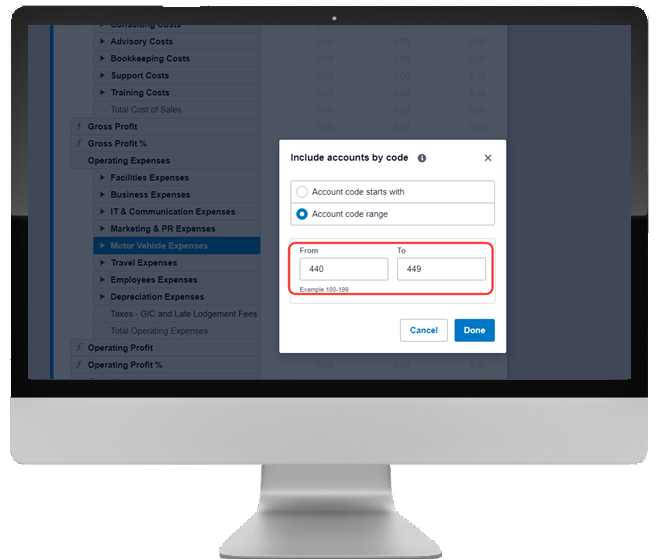

11. Auto-Grouping Account Rules

All Financial Reports are customised by displaying accounts in different groups. As business needs constantly evolve, so is the requirement to create new accounts. This was a real challenge when managing custom reports, as every time new accounts were added to the chart of accounts, all impacted custom reports had to be manually updated.

Xero Account Grouping Rules has resolved this issue. You can now set rules to automatically group accounts within a set code range of numbers or words. This means that as long as your Chart of Accounts has a defined code structure, you can easily set grouping rules when creating Custom Reports.

Any new accounts will automatically be added to the relevant group based on the Grouping Rules you have set up.

12. Tracking Categories comparison (Profit & Loss Report)

Xero has introduced a new option in the Profit and Loss report, which lets you easily add Tracking Categories columns to the report, allowing you to display different categories and compare the two category options within the same column.

This is a great feature, particularly for those businesses that need to track their performance by Areas, State, Departments or Jobs.

By adding Tracking Categories columns to the report, the Profit & Loss will only include the transactions posted to the selected categories.

![]()

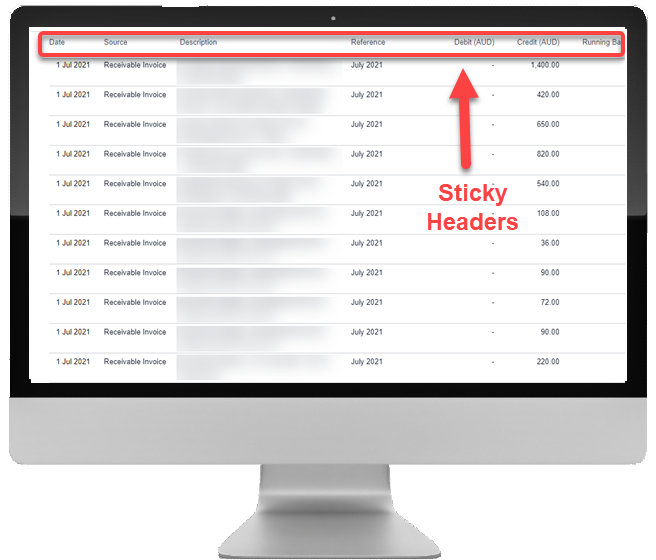

13. Sticky Headers (Transactions Report)

When a transaction report type (for example, the Account Transaction or Trial Balance) returns a high volume of transactions, the column header now sticks on top of the screen every time you scroll down the report page to view more results.

Conclusions

The Xero Development Team has been working hard to facilitate the transition to new reports for all its subscribers. As well as developing new features across the New Reports, they have also created new reports to replace the old version. Furthermore. they have enhanced some of the existing reports to include more data and better ways to filter and customise the report information.

The time to switch is now. If you are still using the old reports, you should start working towards the transition as soon as possible.

The team at Evolution Cloud Accounting has been working with New Reports since 2016. We can create complex custom reports to help you better track your financials as well as audit and reconcile your data.

Would you like to know more about Xero New Report’s features or help to transition your Organisation to new reports? Contact us today and book a consultation with us.

Disclaimer

This blog and attached resources are of general nature and designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.