7 Report Enhancements Xero Released in the Last 12 Months

By Paolo, 20.06.2023

After supporting two Reports technology for a number of years, Xero announced the retirement of their Old Report technology by 31 July 2023. This announcement which came 12 months ago, was followed by a solid plan to expand the development of their “New Reporting” suite and become a comprehensive reporting solution for their platform.

Xero’s ambitious plan included adding a number of features to the Report Centre, creating additional New Reports to replace the previous version, and implementing a number of enhancements to the existing “New Reports”.

In this third and final Blog Article of our New Xero Reports series, we will focus on the 7 enhancements Xero released to their existing “New Reports”, further expanding their functionality and usability. The improvements added to the reports are the result of the feedback provided by Xero users through the Xero Product Ideas Portal.

The 7 Reports’ enhancements released in the last 12 months

We will review the 7 core enhancements Xero has implemented across the existing “New Technology Reports” over the last 12 months. We will start with the first two enhancements applied to all reports and then move to the enhancements applied to individual reports.

1. All Reports – Tracking Columns

Xero has improved the formatting of the Reports’ Tracking Columns. When a date range is the same across all Tracking Columns, the report date will no longer overcrowd the columns’ names, displaying only the Tracking Category name.

2. All Reports – Export to Microsoft Excel

Xero has improved the formatting of the data of all reports exported to Microsoft Excel. Once reports are exported to Microsoft Excel, the following improvements have been made:

- Reports’ view default to 100% (previously 150%)

- Title size and currency fonts have been changed for ease of reading

- Enhanced formatting of cell rows to increase consistency across the report

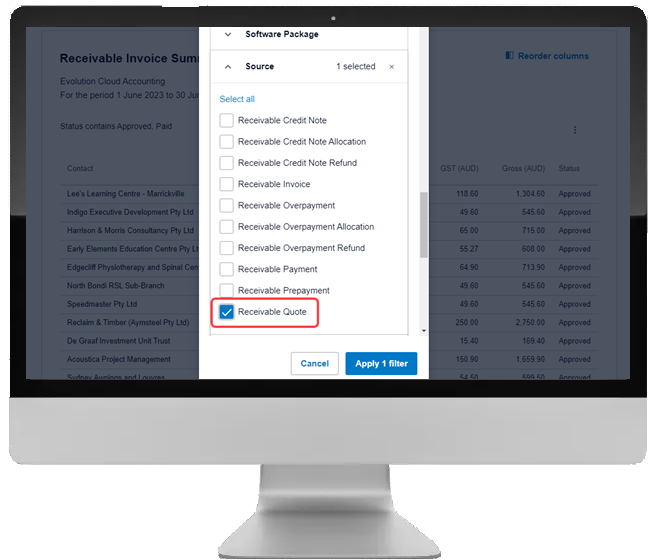

3. Receivable and Payable Invoice Summary & Detail Reports

This is probably the most significant enhancement launched in the last 12 months. For the first time ever, Xero has expanded its report functionality to include Quotes, Purchase Orders and Prepayment transactions.

You can now include Quotes in the Receivable Invoice reports and Purchase Orders in the Payable Invoice reports. You can even create custom reports that exclusively show Quotes, Purchase Orders information and/or Prepayment transactions.

Further enhancements to these Receivable and Payable Invoice reports include the addition of three new columns:

- Late Payment Date;

- Status;

- Contact Account Number.

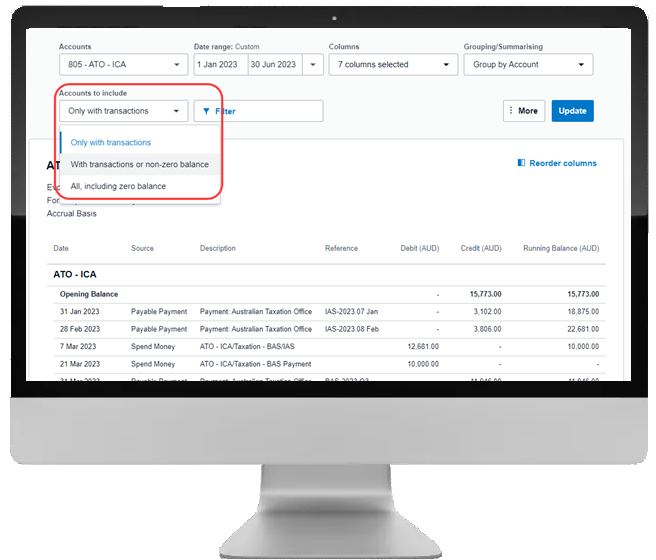

4. Account Transactions Report

Xero has added two new columns to this report: Contact and Invoice Number. You can now add these columns to the default report as well as sort, group and filter transactions by these options.

Further enhancements to this report include the ability to:

- exclude accounts that have been archived from the Accounts dropdown menu;

- show opening balances on both Revenue and Expenses accounts (previously, these were only available for Assets and Liabilities accounts);

- sort the report by account code without losing the opening balances;

- show accounts with no transactions in the selected date range (including accounts with an opening balance and accounts with zero balance).

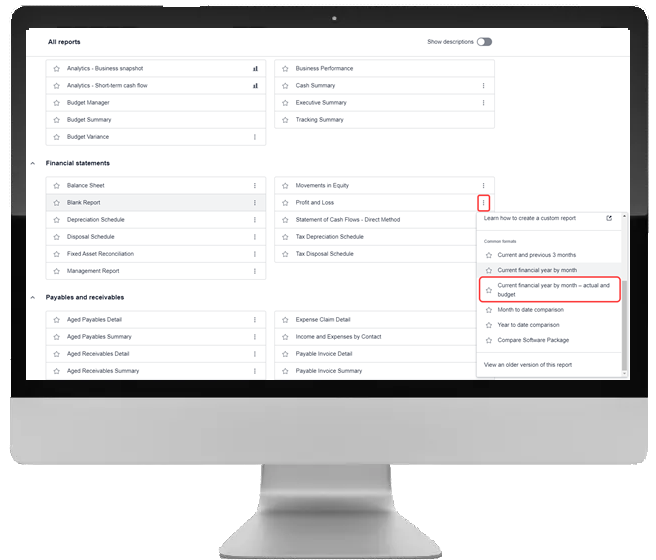

5. Profit & Loss Report

The Profit & Loss report includes the new common format “Current Financial Year by Month – Actual and Budget”.

This report format shows the actual figures to date with budgeted values for the remaining periods.

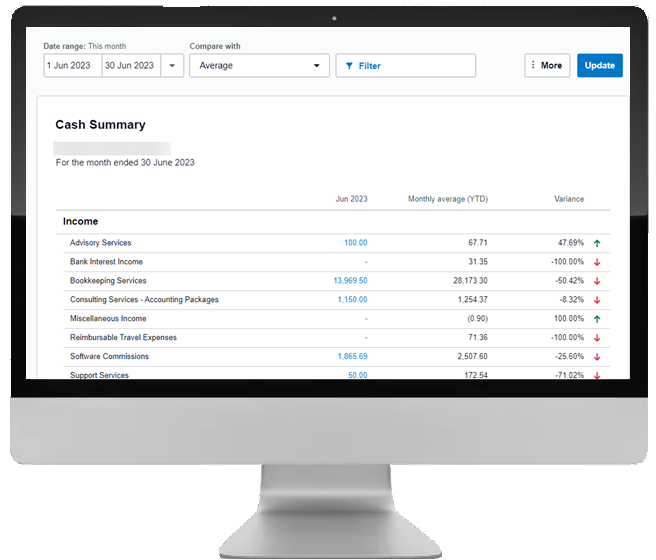

6. Cash Summary Report

The Cash Summary report includes the new common format “Working Capital with other Cash Movements”.

The default view of this report shows working capital with income and expenses. Xero’s new common format customises the report by showing working capital with non-operating movements.

You can save the common format as a custom report or create a report pack by combining both the default and the common format.

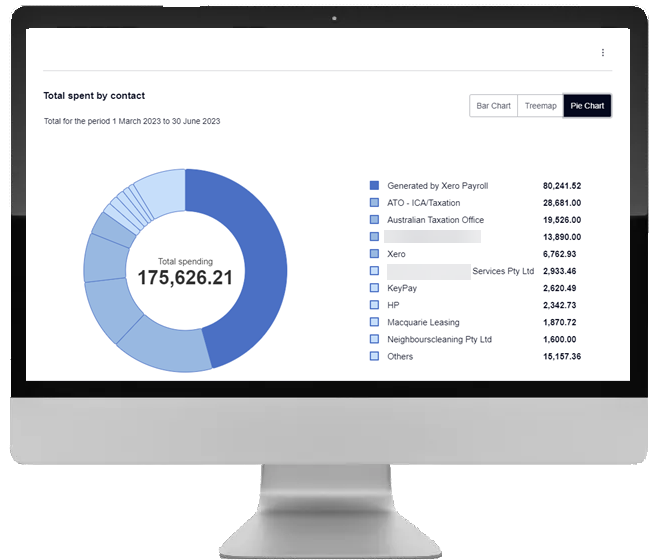

7. Income and Expenses by Contact Reports

Xero has also enhanced these two reports with additional abilities to drill down to the specific transactions for each contact.

Further enhancements include the ability to group and sort, add text blocks, and the contact name to the title of the report. Both reports also show three types of charts:

- Bar Chart;

- Treemap;

- Pie Chart.

Conclusions

Xero continues to expand and develop its New Report platform in an effort to create a comprehensive suite of customisable reports suitable to the variety of its subscribers. As well as developing new reports, additional features and further enhancements, Xero has also provided a range of resources to support its users through the transition from the Old to New reports.

These resources include:

- A number of webinars and interactive courses about Xero New Reports available on Xero Central;

- Product tours on key Financial Reports (Profit and Loss and Balance Sheet) available directly from the Xero Organisation;

- A ‘Tips and Tricks’ panel accessible directly from a wide range of reports on the Xero Organisation;

- Interactive links to help you switch between the Old and New versions of the same report;

- An interactive tool to help you re-configure your old custom reports into the new versions.

You can learn all about the features of Xero’s new reports either via Xero Central or by reading our Xero New Reports Blog Trilogy.

Alternatively, you can contact us and book a consultation with us to help you design a new suite of Custom Reports.

Disclaimer

This blog and attached resources are of general nature and designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.