6 New Reports Xero Released in the last 12 Months

By Paolo, 12.06.2023

Following the announcement to retire the old reports in July 2022, Xero’s priority in the last 12 months has been focusing on expanding the New Report suite and fully replacing the old reports. Xero’s development work includes adding a number of features to the Report Centre, creating additional New Reports to replace the old version and finally, enhancing the current reports by adding features to provide more information and better business insights.

In the second Blog Article of our New Xero Reports series, we will focus on the new reports created by Xero to replace the old versions developed in the last 12 months. Plus, we’ll include a couple of bonus reports Xero is adding to its Report Suite that further expands Xero’s New Report Suite.

Xero New Reports

In this section, we will review the 6 new reports created by Xero and provide a brief summary of each report. We will be assessing the various report features and comparing them with the features included in the old reports.

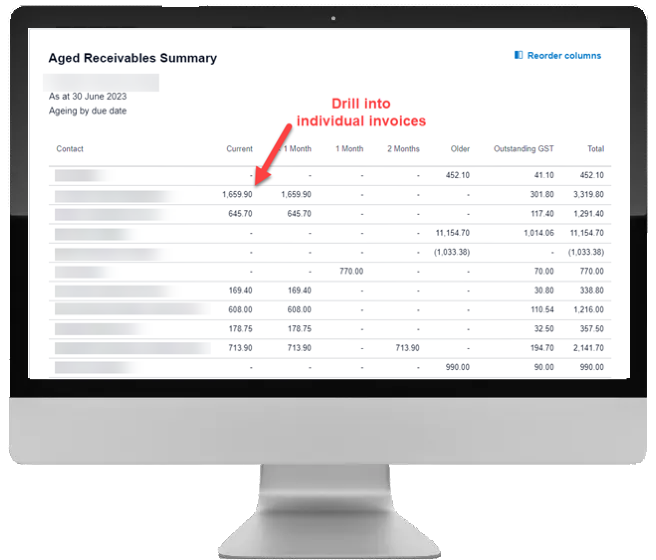

1. Aged Receivables and Aged Payables Reports

The Aged Receivables and Payables Reports provide a view of the amounts owed by your customers or owed to your supplier across different ageing periods. At a summary level, the reports simply provide a list of all Customers or Suppliers and the amount owed by aged period. When run at a detail level, the report also shows the individual invoices owed.

Both Aged Receivables and Payables reports have been re-created using the New Report technology. The new reports come in two formats: Summary and Details, whereas the old report included both options in one report.

Although the combination of Summary and Detail available in the same reports in the old version may have looked like a plus, the reports’ features were fairly limited: Aged Periods were fixed, and no additional columns could be added to the standard report. Finally, the report lacked any customisation.

The new versions of the reports replace all the features from the previous version and add many more. Here’s a comparison table between the two versions:

| Features | Old Version | New Version |

| Summary and Detail in the same report | Yes | No |

| Filtering Ageing Period by Invoice or Due Date | Yes | Yes |

| Drilling into Specific Invoices or Credit Notes | Yes | Yes |

| Determining the Ageing Periods columns | No | Yes |

| Viewing or Hiding Ageing Period columns | No | Yes |

| Including Outstanding GST column | No | Yes |

| Including contact details columns | No | Yes |

| Including Credit Limit columns | No | Yes |

| Including Tracking Categories columns | No | Yes |

| Filtering options | No | Yes |

| Saving as custom | No | Yes |

| Adding Aged Reports to Report Packs | No | Yes |

In conclusion, the new versions of the Aged Reports provide a much more flexible and comprehensive experience than the old version. Thanks to the additional features, they allow Xero users to utilise these reports for a wider scope that goes beyond the core purpose of analysing the impact on Business Cash Flow.

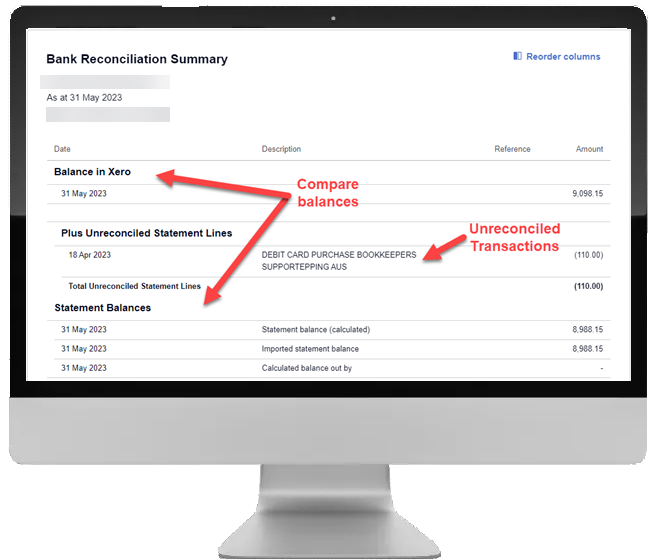

2. The Bank Reconciliation Report Pack

The Bank Reconciliation report allows you to compare the balance of all transactions posted against a specific Bank Account or Credit Card in Xero against the Balance from your issued Bank Statements.

The report runs across three separate sections:

- Bank Reconciliation Summary

This section displays the balance calculated from all the Xero transactions posted against the selected Bank Account for the reporting period and the calculated Statement Balances.This is the main section of the Bank Reconciliation report. If the balances reported in this section match with your Bank Statement balances, the other two sections become redundant.The report also flags any transactions on ‘Unreconciled’ status. These transactions could represent the source of discrepancy between Xero and the Bank Statement. Unreconciled transactions include transactions:- that are still unreconciled in the Bank Feeds;

- that have been posted on a different date from the date on the Bank Statement;

- that have been manually posted to a Bank Account in Xero but have never actually been withdrawn or deposited in the Bank Account.

- Statement Exceptions Report

This section provides any anomalies amongst the transactions posted in Xero, including:- transactions posted by a user and manually marked as reconciled;

- deleted bank feed transactions;

- duplicate statement lines.

- Bank Statement Report

This section lists all bank account statement lines for the reporting period. This section should only be used when the Bank Reconciliation summary displays no unreconciled transactions.However, the report balance still does not match the Statement Balance. In this instance, you would need to manually compare each transaction listed in the report against each line on the Bank Statement.

At this stage, the New version of the report is a straightforward replacement for the Old Version. However, Xero has plans to further expand this report to provide a better reconciliation experience, including the ability to manually type the Statement Balance into the report to facilitate the balance comparison.

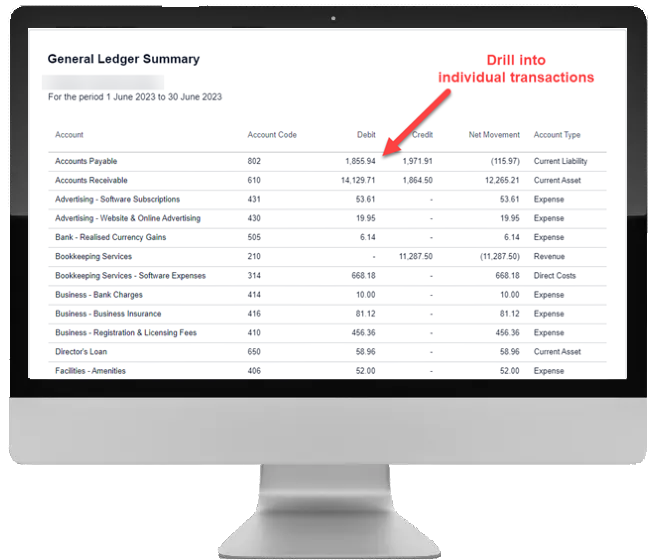

3. General Ledger Summary and Detail Reports

The General Ledger report is a list of your Business’s financial transactions.

At a summary level, the report shows the total Debits and Credits of the transactions posted for each account during the selected period. The Detailed version of the report, instead, displays the individual General Ledger transactions for each selected account within the report date range.

The Net Movement column represents the difference between the total Debit and Credit columns.

Although the core of the report features is the same between the old and new versions, the new reports provide both additional columns (i.e. Account Type, GST Rate and GST Rate Name) and filtering options, previously unavailable in the Old Version.

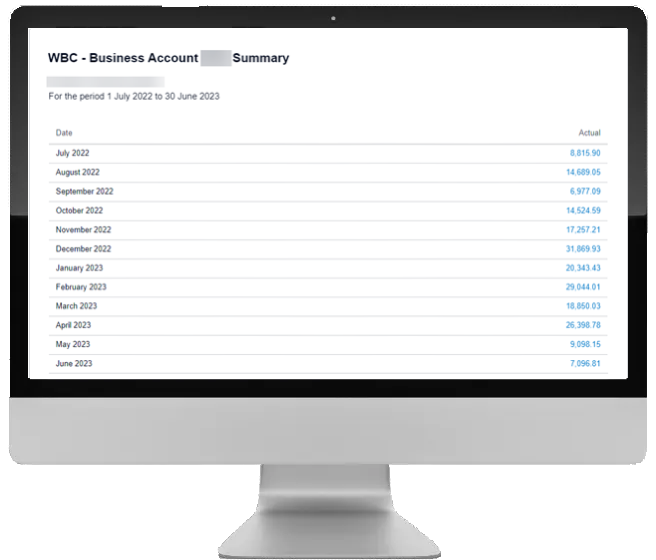

4. Account Summary Report

The Account Summary report provides a monthly summary view for a specific account over a selected period. The report can be run either on Cash or Accrual basis.

When run on an Accrual basis, the values are included in the reporting period where the relevant invoice or bill is approved. Whereas when run on a Cash basis, the values are included in the reporting period where the relevant invoice or bill is paid.

Spend and Receive money transactions are included in both Accounting Basis in the reporting period where the transaction is created.

The new Account Summary Report is a straightforward replacement for the Old Version. The Report features are very similar between the two versions. However, the New Report also allows you to select date ranges unrestricted by a full monthly period, previously restricted in the Old Version.

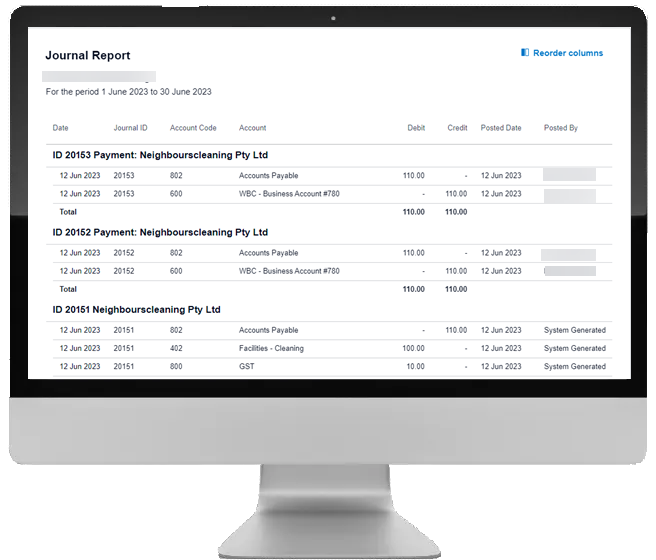

5. Journal Report

The Journal Report provides a list of all journal entries posted from various transactions (Sales, Purchases, Spend and Receive Money, Inventory Adjustments, Payroll and Manual Journals).

Similar to the Accounts Summary, the new Journal Report is a straightforward replacement for the Old Version. However, additional filter options have been added to further customise the report, previously unavailable in the Old Version.

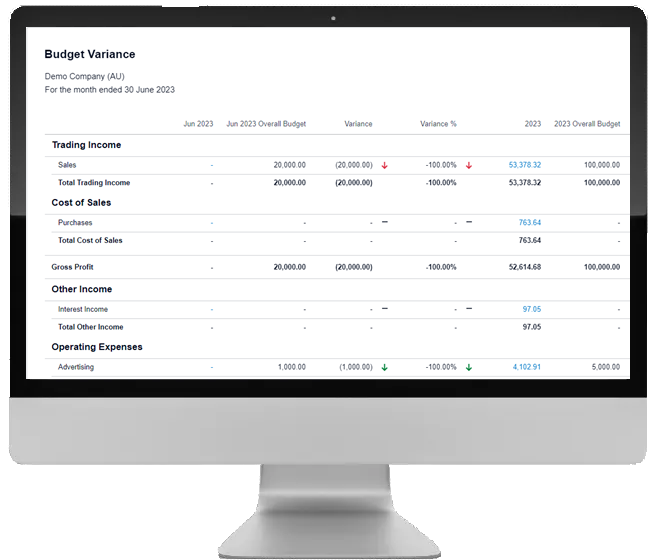

6. Budget Variance Report

The Budget Variance report lets you compare your business revenue and expenses with one or more budgets uploaded in your Xero Organisation. You can either select a date range or choose from a list of set reporting periods, such as month-to-date. The report includes Actual and Budget values as well as Variance values and percentages.

The new version of the report is still a work in progress and misses some of the key features previously available in the Old Version. In particular, the ability to compare different reporting periods is still unavailable in the old report.

However, the new version does include other features, including running the report in multiple currencies, the option to include the report in Report Packs, and finally, the ability to save custom versions of the report, previously unavailable in the Old Version.

Bonus Reports

We’ll also look at two more reports, one that is due for release soon and a second one released early this year that did not exist in the Old Report suite.

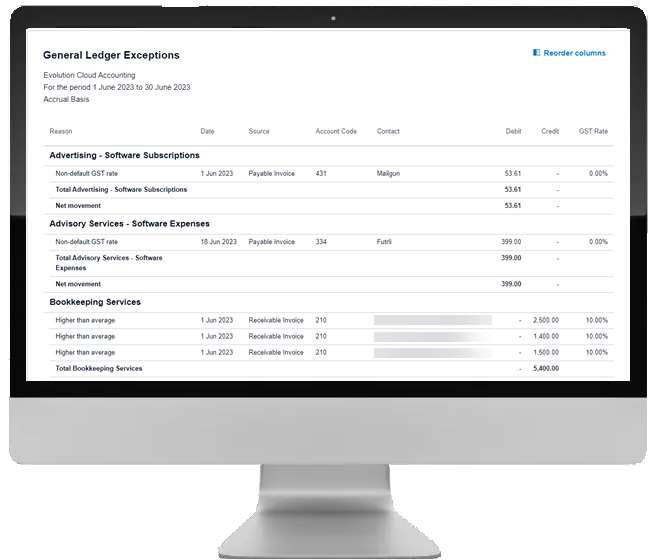

1. General Ledger Exceptions Report

This report was a separate section of the Old Version of the General Ledger Report. The report details General Ledger transactions that are out of the ordinary based on other transactions posted to the same account.

The new General Ledger Summary or Detail Reports do not include the Exceptions section. However, Xero has announced that they are designing a separate General Ledger Exceptions report with additional features. This will hopefully be released as soon as possible (hopefully before the retirement of Old Reports on 31 July 2023). At this stage, we do not have any more details of what these new features will be.

* Update

On 14 June 2023, Xero announced the New General Ledger Exception report is now part of the Report Centre. The new report includes the following features:

- Customisable columns (adding and removing, sorting and re-ordering);

- Accounting basis (Cash or Accruals);

- Multi-currency support;

- Contact and Invoice/Bill association (the report displays the contact assigned to the relevant Invoice or Purchase transaction)

2. Duplicate Statement Lines Report

This is a new report that Xero launched in the last 12 months that never existed in the previous version.

The Duplicate Statement Lines Report flags any duplicate Bank Feed transactions that occurred between manually importing bank transactions that overlapped the bank transactions coming from the automatic feeds.

The report looks for duplicates by comparing the date and amount fields of all statement lines within a Bank Account. If a transaction has the same date and amount, the report further investigates the potential duplication by looking for an exact match across the bank reference/descriptions fields.

You should compare any duplicate lines flagged in this report against your actual Bank Statement and take the correct action.

The report does not flag either partial matches or duplicate lines already flagged in the Bank Feeds screen. These are already listed in the Exceptions section of the Bank Summary report.

Bonus Tip

Want to create the ultimate Bank Reconciliation Report? Create a Report Pack that includes the following reports:

- Account Summary Report

(displaying the company’s Bank Accounts and Credit Cards for the relevant periods); - Bank Reconciliation Report;

- Uncoded Statement Lines Report;

- Duplicate Statement Lines Report;

Save it as a Custom Report and set it as a favourite.

Conclusions

In the last 12 months, Xero has worked relentlessly to create a comprehensive report suite that will stand on its own after the “Old Guard” Reports retire on 31 July 2023.

Whether you prefer the look and feel of the old reports or not, the decision has been made, and these reports will disappear soon. Your business must move forward and still be able to rely on reports to be run effectively.

There isn’t much time left to transition. If you are still using the old reports, here’s a great checklist:

- Make a plan to start the transition process

- Prioritise the reports you use more frequently

- Do a side-by-side comparison between Old Reports and New Reports

- Migrate your current custom old reports to the new version by using the Xero report conversion feature

- Review the new reports and check what else you can do with the additional functionality to get better insights into your business.

Alternatively, you can get support from a Xero Advisor to help you create a suite of new custom reports that suit your business needs. Contact Evolution Cloud Accounting and book a consultation with us.

Disclaimer

This blog and attached resources are of general nature and designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.