Key Rates and Thresholds FY 2026

By Paolo, 15.06.2025

Fair Work Australia and the ATO have released new Key Rates and Thresholds applicable for the Financial Year 2026. Here are some of the most significant ones affecting Australian businesses and individuals.

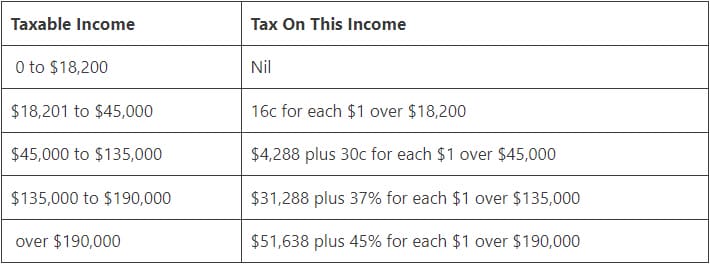

Individual Tax Rates

Individuals’ Income Tax Rates remain unaltered. The Tax Rates introduced from 1 July 2024 continue to apply for the FY2026.

Here’s a table summary of the Individual Tax Rates which started from 1 July 2024.

Payroll Key Rates and Thresholds

Fair Work Minimum Wage and Award Pay Conditions

The National Minimum Wage has increased for FY 2026 by 3.5%. The new Minimum Wage Pay Rates are:

- $24.95 Hourly Rate (Full-Time Employees*)

- $948.00 Weekly Salary (Full-Time Employees*)

*25% Loading still applies to Casual Employment

This percentage will also apply to all Modern Awards’ minimum wages.

Allowances

Laundry and Dry Cleaning Allowance

The annual tax-free laundry allowance remains at $150 per annum.

Car, Meals and Travel Allowances

The cents per km threshold for FY 2026 has not yet been changed. At this stage, the rate is still $0.88 per km.

The Overtime Meal Allowance threshold for FY 2026 has increased to $38.65 per meal.

The FY 2026 Overnight Travel Allowances have been updated.

ATO – Dry Cleaning and Laundry Allowances

ATO Overnight Travel Allowances TD 2025/4

Superannuation Key Rates and Thresholds

The percentage of Superannuation Contribution Guarantee has increased to 12% of Ordinary Time Earnings for FY 2026.

The minimum monthly threshold of $450 per month was removed from 1st July 2022.

The quarterly superannuation maximum contribution cap has decreased for FY 2026 to $62,500 wages per quarter (allowing a maximum amount of Quarterly Superannuation Guarantee Contribution of $7,500).

The annual Concessional Contribution remains at $30,000 per annum with the ability to carry forward unpaid contributions for a 5-year period.

The Annual Non-Concessional Contribution cap also remains at $120,000 with the ability to carry forward unpaid contributions for a 3-year period.

ATO – Superannuation Key Rates and Thresholds

Lump Sums and Employment Terminations

Genuine Redundancy and Early Retirement Payment Limits

The limit of the Tax-Free Component for Genuine Redundancy and Early Retirement Scheme has increased for the FY 2026 to the following:

- Base Limit: $13,100

- Each Year of Completed Service: $6,552

Death & Life Benefits ETP & Whole of Income Cap

The ETP cap for both Death & Life Benefits has increased for FY 2026 to $260,000.

The Whole of Income Cap stays at $180,000.

ATO – Tax-Free on Genuine Redundancy

ATO – ETP and Whole of Income Caps

Payroll Tax Rates and Thresholds

The applicable Payroll Tax rates and thresholds for the FY 2026 are the following:

- ACT – The Payroll Tax rate and thresholds remain unchanged at 6.85% with an annual threshold of $2 million in annual Australian Taxable wages;

- NSW – The Payroll Tax rate and thresholds remain unchanged at 5.45% with an annual threshold of $1.2 million in annual Australian Taxable wages;

- NT – The Payroll Tax rate and thresholds remain unchanged at 5.50% with an annual threshold of $1.5 million in annual Australian Taxable wages;

- QLD – The Payroll Tax rate and thresholds remain unchanged from 4.75% to 4.95%, with an annual threshold of $1.3 million in annual Australian Taxable wages;

- SA – The Payroll Tax rate and thresholds remain unchanged at a maximum of 4.95% with an annual threshold of $1.5 million in annual Australian Taxable wages;

- TAS – The Payroll Tax rate and thresholds remain unchanged at 6.1% with an annual threshold of $2 million in annual Australian Taxable wages;

- VIC – The Payroll Tax rate and thresholds remain unchanged at 4.85% or 2.425% (applicable to regional employers) with an annual threshold increase to $1,000,000 in annual Australian Taxable wages

Note: since FY 2025 the 1 Mil Annual Threshold only applies in full for businesses with wages up $3 mil. Businesses with wages between 3 and 5 mil receive a pro-rata of the Annual Threshold, and finally business with over $5 mil in wages no longer receive any threshold; - WA – The Payroll Tax rate and thresholds remain unchanged at 5.5% with an annual threshold of $1 million in annual Australian Taxable wages;

Motor Vehicles Key Rates & Thresholds

The Income Tax and GST Threshold for purchasing a new car remains unchanged at $69,674.

The Luxury Car Thresholds also remain unchanged for the FY 2026 at the following:

- $80,567 (Non-Fuel-efficient vehicles)

- $91,387 (Fuel-efficient vehicles)

ATO – Luxury Car Tax Rates and Thresholds

Instant Asset Write-Off

The Instant Write-Off for Fixed Assets valued up to $20,000 has been extended to FY 2026.

Here’s a table summary of the Instant Asset write-off thresholds for Small Businesses (under $10 Million per year).

Here’s a table summary of the Instant Asset write-off thresholds for Large Businesses (over $10 Million per year).

Is your Accounting Software up to date? Compare the latest updates on the ATO and Fair Work Rates and Thresholds with the FY 2025 Key Pay Rates & Thresholds.

Disclaimer

This blog and attached resources are of general nature designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.