Paying Employees on Workers’ Compensation

By Paolo, 06.01.2022

Workers compensation is a form of insurance providing payments in lieu of wages and medical benefits to employees injured in the workplace. Employees who have suffered a work-related injury or illness may be entitled to claim workers’ compensation. The process involved in making a claim to the Insurance Company changes from State to State and from Insurance company to insurance company. Please refer to your HR Consultant if you need help with submitting a Workers Compensation claim.

Once submitted, the Insurance Company will assess the claim and then make a determination whether the Employee can still work on reduced duties or is required to be absent from work. The Insurance Company will also decide whether to pay the claim directly to the Employee or request the Employer to pay the Employee through their regular payroll and then pay the claim to the Employer.

Finally, if the Claim is approved, the Insurance Company will request the Employer to submit an estimate of the employee’s wages based on the Employee’s pay history of the previous 12 months. This will allow the insurer to correctly estimate the payments they need to make in lieu of wages. The percentage of wages payable for workers compensation varies depending on the length of time the worker is going to be absent from work:

- 0 -13 weeks > 95% of the employee’s estimated wages;

- 14 – 130 weeks > 80% of the employee’s estimated wages.

Tax Implications on Workers’ Compensation Payments

When paying Employees Workers Compensation, these payments are taxed as any other Ordinary Earnings. When the Employer receives the claim payments from the Insurance Company, these payments are deemed assessable income, however, they are paid to the Business net of GST.

Employees on Lighter Duties

If an Employee is currently receiving payments of Workers’ Compensation but placed on Lighter Duties. These payments are subject to Superannuation Guarantee. The Employee is also entitled to accrue Annual Leave, Personal Leave and Long Service Leave Entitlements whilst on lighter duties and also to apply for leave during these times.

The circumstances are much more complex when dealing with Employees receiving Workers’ Compensation payments and being absent from work.

Employer’s Liabilities applicable to Workers’ Compensation Payments

The most difficult task is to determine if an Employer needs to pay certain liabilities whilst one of their Employees is absent on Workers’ Compensation. This task involves reviewing a number of Federal and State & Territories Laws, as well as ruling from a local court on specific cases.

Applicable Employer’s liabilities during Workers’ Compensation include:

- Superannuation Accruals

- Annual & Personal Leave Accruals

- Long Service Leave Accruals

- The ability to take Annual or Personal Leave whilst on Workers’ Compensation

- Other Employer’s liabilities (Payroll Tax and Workers Compensation Insurance)

Superannuation during Workers Compensation

Payments of Workers’ Compensation in lieu of wages may be subject to Superannuation depending on a number of factors.

If an Employee is absent from work and the Insurance Company has decided to pay the claim directly to them, then these payments are exempt from Superannuation.

Whereas, if the Employer is required to pay the Workers’ Compensation payments through their payroll, they will need to review three separate pieces of legislation to assess whether Superannuation accrues on these payments.

- The Superannuation Guarantee Ruling (SGR 2009/2)

Section 18.151 of the Super Guarantee Ruling states that payments of Workers’ Compensation made to Employees whilst absent from work are not deemed Ordinary Time Earnings and therefore are not subject to Superannuation. - The Employee’s Classified Award or Enterprise Agreement

The next area Employers should check is their Employee’s classified Award or the Enterprise Agreement. Specifically, the section: ‘Absence from work’. In this section, a number of Awards state that ‘… the employer must also make superannuation contributions… for the period of absence from work of the employee due to work-related injury or work-related illness provided that the employee is receiving workers’ compensation payments directly from the Employer…‘ - The Workers’ Compensation Act of the State where the Employee resides

Some Workers’ Compensation Acts include a provision that mandates Employers to pay Superannuation to Employees whilst paid Workers Compensation.

Accruing and Taking Annual or Personal Leave whilst on Workers’ Compensation

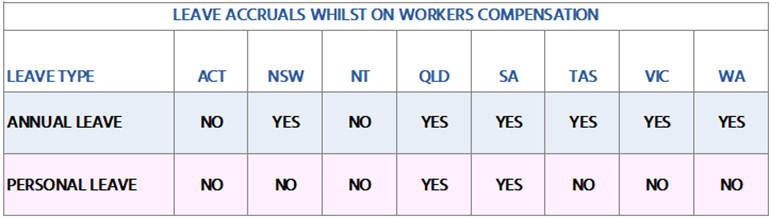

Section 130 of the Fair Work Act 2009 states that an Employee is not entitled to accrue or take Annual or Personal Leave during absence due to illness or incapacity to work. However, the same section further includes a clause that allows a Workers’ Compensation Act to supersede this ruling. Furthermore, the ruling of some local court cases that took place in recent years even contradicted the Workers’ Compensation Act in their jurisdiction and ruled in favour of an Employee to accrue Annual Leave during this period.

Therefore, Employers may be required to accrue Annual Leave or Personal Leave entitlements for their Employees absent on Workers Compensation. To simplify this task, Fair Work has published a webpage that provides a recap of Annual and Personal Leave by State whilst on Workers’ Compensation. The following table provides a summary of Annual and Personal Leave accruals by State as of December 2021.

This page is constantly reviewed by Fair Work and subject to amendments based on the outcome of new Court rulings. Therefore, we strongly advise consulting the Fair Work webpage to ensure the table provided below is still up to date.

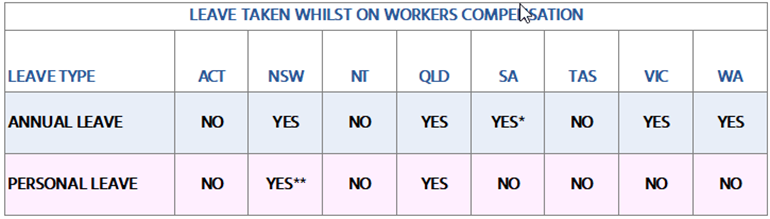

Taking Annual or Personal Leave whilst on Workers’ Compensation

It may sound completely ridiculous that an Employee is allowed to take Paid Leave (Annual or Personal Leave) whilst on another Paid Leave (Workers’ Compensation). However, this is allowed under some of the State or Territory Workers’ Compensation Act. Once again, the same Fair Work Webpage also lists in what States Employees are allowed to take Paid Leave at the same time as being paid Workers’ Compensation. The table below provides a summary of these entitlements as of December 2021.

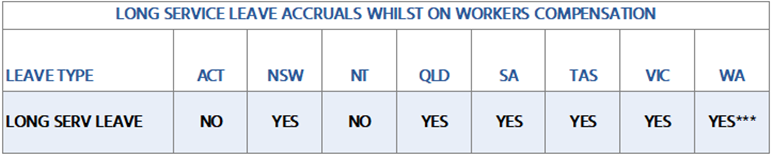

Accruing Long Service Leave Entitlements during Workers Compensation

As Long Service Leave is a State’s Entitlement, the Long Service Leave Act from the Employee’s Jurisdiction will determine whether this period of absence is counted as continuous service or not. The following table provides a summary of Long Service Leave entitlements for each State.

Other Employer’s Liabilities whilst on Workers’ Compensation

Workers Compensation payments are excluded from the calculation of both the Workers’ Compensation Annual Declaration and Payroll Tax.

* In South Australia Employees who have been on Workers’ Compensation for longer than 52 weeks are no longer entitled to accrue or take Annual Leave as the SA Workers Compensation Act considers the final 4 weeks of the 52 weeks of absence on Workers’ Compensation Annual Leave Taken.

** In New South Wales if the payment for Personal Leave is higher than the Workers Compensation payment, then the payment of Personal Leave will be the difference between the Workers’ Compensation Payment and the Personal Leave Payment.

*** In Western Australia Long Service Leave will only accrue for the first 15 days of absence from work.

Processing Workers’ Compensation Payments through Payroll

Based on the number of different rulings that affect Workers Compensation payments, it is important to set up the Workers’ Compensation Pay Category correctly. Businesses that employ staff in multiple Jurisdictions and/or classified under different Awards may need to create the same Pay Category but catered for different States and/or Awards.

Finally, if an Employer decides to pay the full wage to the Employee whilst on Workers’ Compensation, the pay will need to be separated into two Pay Categories:

- Workers’ Compensation, where the percentage of wages paid by WorkCover is recorded, and

- the standard Wages & Salaries category assigned to the Employee for the difference.

We have created comprehensive User Guides to help our Clients set up the Workers Compensation Pay Item and process payments whilst on Workers’ Compensation. These User Guides are available to our Clients on our Knowledge Base website. We have also created a PDF Summary on Leave Entitlements on Workers Compensation for our readers to print and keep in their office.

References

https://www.legislation.gov.au/Details/C2017C00323

https://www.ato.gov.au/law/view/print?DocID=SGR/SGR20092/NAT/ATO/00001

https://www.legislation.act.gov.au/View/a/1951-2/current/html/1951-2.html

https://worksafe.nt.gov.au/workers-compensation

https://www.legislation.qld.gov.au/view/html/inforce/current/act-2003-027

https://www.legislation.sa.gov.au/lz?path=%2FC%2FA%2FReturn%20to%20Work%20Act%202014

https://www.legislation.vic.gov.au/in-force/acts/workers-compensation-act-1958/160

Disclaimer

This blog and attached resources are of general nature designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.