STP Phase 2 Salary Sacrifice and Other Deductions

By Paolo, 31.05.2022

STP Phase 2 is expanding the payroll data submitted to the ATO to support the administration of the Social Security system. This latest requirement has introduced significant changes to the way payroll information is reported to the Australian Taxation Office.

Through this new phase, the ATO has introduced new employment basis and tax treatment options and a granular way to report wages and salaries, previously reported under Gross Payments.

STP Phase 2 changes also impact the reporting of a number of Payroll Deductions including Salary Sacrifice Arrangements, Union Fees and Child Support.

STP Phase 2 – Salary Sacrifice Arrangements

A Salary Sacrificed Arrangement consists of pre-tax amounts the employee agrees to have deducted from the regular salary in exchange for either additional Superannuation contributions or other non-cash benefits. For a Salary Sacrifice arrangement to take place, an effective Salary Sacrifice agreement must be made between the employer and the employee, whereby the employee agrees to forego part of their salary or entitlements in return for other benefits of equal value.

The ATO defines an effective Salary Sacrifice agreement when the following conditions are met:

- the agreement must be in writing;

- the agreement must be in place before the work has been performed;

- the employee must agree to permanently forgo the sacrificed salary for the period of the arrangement.

Some of the non-cash benefits that can be part of a Salary Sacrificed agreement include:

- Superannuation;

- Purchased Leave;

- Novated Leases;

- Workplace Giving;

- Health insurance or Life insurance;

- Child Care fees;

- Parking permits;

Employers should discuss with their Tax Advisors before agreeing with their employees to salary sacrifice certain non-cash benefits, as these payments may attract Fringe Benefits Tax as an extra cost for the employer.

As these amounts are deducted from the employee’s Gross Earnings, they are not relevant to the ATO when determining an individual’s assessable income. However, Services Australia takes into account Salary Sacrificed amounts when assessing an individual’s eligibility to access Social Security programs.

Therefore, STP Phase 2 modifies the reporting requirements of these amounts. Previously excluded from Single Touch Payroll Phase 1, employers will now be required to report salary sacrificed amounts through STP using the following categories:

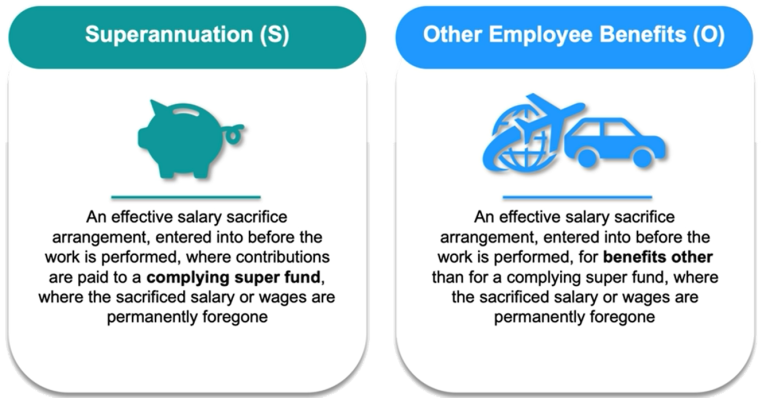

- Superannuation (S)

When the employee agrees to have part of their Pre-Tax Salary paid into a Superfund of their choice; - Other Employee Benefits (O)

When the employee agrees to have part of their Pre-Tax Salary paid towards other non-cash benefits (i.e. a Novated Lease)

When an employer and employee reach a Salary Sacrifice agreement, Gross Wages and Salary Sacrificed amounts must be reported as follows:

- The full amount of Gross Wages pre-salary sacrifice;

- The Salary Sacrifice Amount(s).

The gross amount after the Salary Sacrifice deductions is no longer reported. The ATO will calculate this value by subtracting the salary sacrificed amounts from the pre-salary sacrifice gross wages.

The following illustration provides an example of how Gross Wages and Salary Sacrificed amounts are reported through STP Phase 2.

Finally, it is important to remember that the changes in reporting of Salary Sacrificed arrangements in STP Phase 2 do not alter the current reporting requirements of these amounts in other tax forms, such as the Business Activity Statement. Furthermore, STP reporting does not alter the calculation of Super on Salary Sacrificed amounts as stipulated in the Super Guarantee Ruling.

STP Phase 2 – Post-Tax Deductions

STP Phase 2 requires employers to report only two Post-Tax Deductions:

- Union and Professional Fees;

- Workplace Giving.

Both these STP Categories already existed in STP Phase 1. However, the ATO narrowed down the reporting scope of these categories.

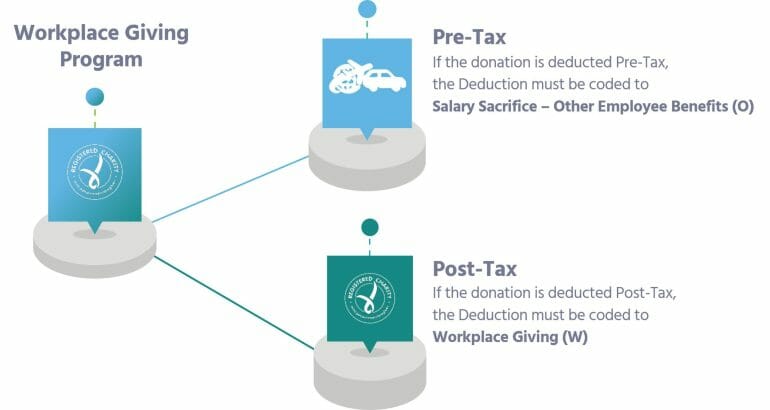

Under STP Phase 2, when Union Fees or Workplace Giving amounts are deducted as pre-tax deductions (as part of a Salary Sacrifice agreement), they must be reported under the STP Category: Salary Sacrifice – Other Employee Benefits (O).

Only when Union Fees or Workplace Giving amounts are deducted as post-tax deductions should they be reported under the Union & Professional Fees (U) or Workplace Giving (W) STP Categories.

The diagram below illustrates an example applicable to these deductions.

STP Phase 2 – Child Support Deductions

STP Phase 2 will also include the ability for employers to report Child Support Deductions to Child Services Australia. This component of STP is optional for both the Digital Software Provider and the employer.

STP Phase 2 provides two categories to report Child Support Payments:

- Child Support Deductions (D)

These are amounts withheld under Section 45 Notice of the Child Support Registration and Collection Act. These deductions are generally the same amount each pay period, and they are subject to protective earnings. - Child Support Garnishee (G)

These are amounts withheld under Section 72A Notice of the Child Support Registration and Collection Act. These amounts are not subject to preserved earnings and can be either the same periodical values or one-off payments.

Employers can identify the correct type of Child Deduction by reviewing the Child Support Notice issued by Child Services Australia. The notice specifies the relevant section of the Child Support and Collection Act.

STP Phase 2 will only impact the final stage of the Child Support Deduction process: the issuing of the payment remittance. Although this is only a small change, it should still provide relief to the reporting burden of the employer.

The way STP reports to Child Services Australia is the same as the reporting process for Services Australia. First, the STP pay event is sent to the ATO, and then the ATO reports to Child Services Australia only the employee data that is required to pay child support.

The following illustration displays the Child Support payment process under STP Phase 1 and STP Phase 2.

The difference in the reporting requirements between STP and Child Services Australia may present challenges with this process in certain scenarios.

Single Touch Payroll reports YTD values, whereas Child Services Australia’s reporting requirements focus on each pay period. This means when the STP report is received by Child Support Australia, the child support payment for the pay period is calculated by subtracting the YTD values from the previous STP pay event from the YTD STP values of the current pay period.

Child Support Services also requires employers to report nil deductions. STP Pay events only report where payments are made. This means if a Child Support payment is skipped due to the employee being on unpaid leave or not reaching preserved earnings, the employer may need to revert back to manual reporting for Child Support deductions. This will also depend on how the payroll software provider will manage nil STP pay events.

Although employment terminations are included in STP, this information is not passed to Child Services Australia. Therefore, the employer will still be required to manually notify Child Services when an employee that is required to pay Child Support deductions is no longer employed by their Company.

If a business shifts into STP Phase 2 in the middle of the Financial Year, the employer will first need to send a manual report to Child Services Australia listing all employees’ child support deduction payments, including the first payment submitted via STP. Finally, for Garnishee notices, the employer will also need to obtain an updated Payment Reference Number from Child Services Australia before submitting the first STP pay event.

Conclusion

The change in reporting Pre and Post-Tax deductions to the ATO through Single Touch Payroll represents another of the many changes STP Phase 2 has introduced into Australian Payroll.

Employers are encouraged first to contact their Digital Software Providers (DSP) and find out how Salary Sacrifice and Post-Tax deductions are managed through STP Phase 2. Subsequently, they should review their current payroll settings and update them accordingly.

It is also important to review other processes, in particular how notifications are issued to both Services Australia and Child Services Australia.

This can represent quite a challenge for Australian small and medium businesses which are already strained on resources due to the impact of both COVID and major natural disasters.

Acquiring knowledge to familiarise themselves with this new ATO initiative can be a long and difficult process, especially when their understanding of payroll is rudimental. It is therefore advisable for small businesses to hire qualified payroll experts and delegate this ongoing complex task.

References

Disclaimer

This blog and attached resources are of general nature designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.