STP Phase 2 Disaggregation of Gross Earnings

By Paolo, 30.05.2022

The first phase of Single Touch Payroll focused exclusively on the provision of Payroll data for the benefit of the Australian Taxation Office.

STP Phase 1 supplied Payroll Data to the ATO for two key purposes: tracking Superannuation payments and digitising Payment Summaries to facilitate the lodgement of individual tax returns.

Therefore, the STP Pay Event simply included the total of the aggregated amount of gross income, tax and super. The only itemised pay items were some specific types of allowances and termination payment types (ETPs and Lump Sums) that directly affected the individual’s income tax reporting.

The goal of STP Phase 2, is for the payroll data to also support the administration of the Australian Social Security System. Once submitted to the ATO via STP, the payroll data will sync automatically to Services Australia for individuals with a Centerlink CRN (Customer Reference Number).

Services Australia requires much more detailed data to correctly determine the assessable income for Social Security. Therefore, in order for Services Australia to utilise the payroll data submitted through Single Touch Payroll, STP Phase 2 expands the payroll information by itemising the payment types, originally reported under ‘Gross Payments’, into a number of individual components reported separately in the STP Pay Event. This process is defined as ‘Disaggregation of Gross Earnings’

This blog article provides a detailed analysis of the process of ‘Disaggregation of Earnings’ and an overview of each itemised payment type reported under STP Phase 2.

Disaggregation of Gross Earnings – Gross Payments

Originally reported under Gross Payments, STP Phase 2 itemises the different pay components into the following categories:

- Gross payments;

- Paid Leave;

- Overtime;

- Bonuses & Commissions;

- Director’s Fees;

It is important to understand that the change in reporting in STP Phase 2 only affects the way the information is reported to the ATO and other Government Agencies. The process of disaggregation of gross earnings does not alter any of the current ATO, Fair Work or State legislation applicable to employees’ pays and entitlements.

Gross Payments

Although Gross Payments are disaggregated under STP Phase 2, some pay items still fall under this STP Category. Generally, Pay items reported under Gross Payments are payments classified as Ordinary Time Earnings, including Base Hourly or Salary, Casual Loading and Shift Penalty rates.

Paid Leave

STP reporting only applies when payments are involved, nil value payroll transactions are not reported through STP. Therefore, when reviewing Paid Leave the ATO only included the time the employee is absent from work and paid for this time as part of a type of their leave entitlements.

Periods of absence reported as any type of Unpaid Leave and Leave accruals are not part of Single Touch Payroll.

Paid Leave is further classified into:

- Other Paid Leave (O)

- Paid Parental Leave (P)

- Workers Compensation (W)

- Cash Out Leave in Service (C)

- Unused Leave at termination (U)

- Ancilliary & Defense Leave (A)

** Superannuation may be payable during the absence on Worker Compensation depending on the employee’s classified Award. Please check your Industry Award to make the correct determination.

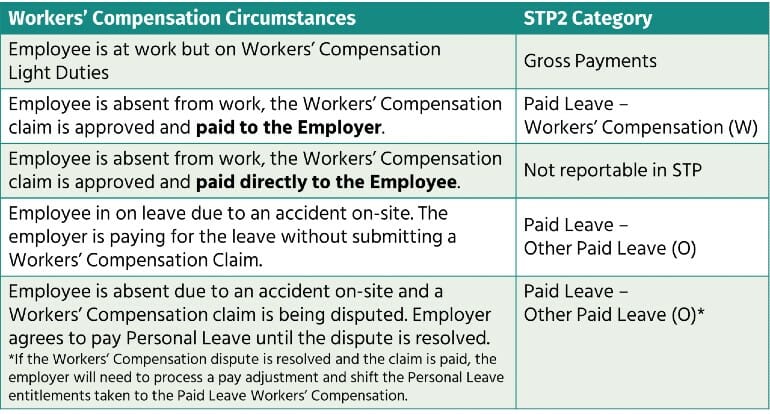

The Fine Prints – Workers’ Compensation

The correct way to report Workers’ Compensation under STP Phase 2 changes based on the circumstances.

More information on payments of Workers’ Compensation is available on a separate blog published on our website.

The Fine Prints – Paid Parental Leave

Included in the Parental Leave entitlements is the option for an employee to access up to 10 ‘Keeping in Touch Days’. These are days the employee may return to work to attend training, meetings or work functions whilst on Parental Leave to keep up to date with the workplace.

If an employee accesses any Keeping in Touch Days, the payment of these days must be reported under Gross Payments, not Paid Parental Leave.

More information on Paid Parental Leave is available on a separate blog published on our website.

Overtime

Overtime reporting in STP Phase 2 includes all payments related to Overtime Earnings, including:

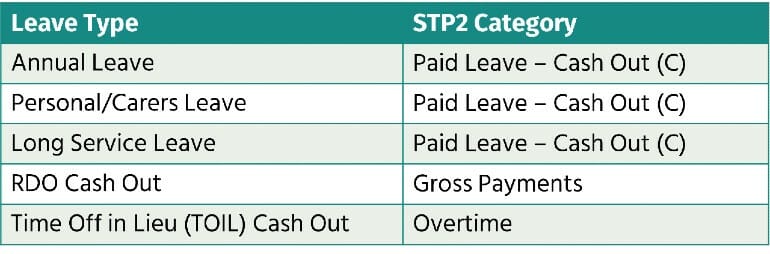

The Fine Prints – Cashing Out Leave

The ability for an employee to apply for Cash Out leave, changes depending on a number of factors applicable to a specific leave type.

- Annual Leave – The Fair Work Act allows a maximum of 2 weeks per year as long as after the cash out the employee still have a remaining annual leave balance of 4 weeks or more. However, some Awards have different provisions, make sure you check your Industry Award or Enterprise Agreement to correctly determine the amount of leave an employee can cash out;

- Personal Leave – Personal Leave is generally not cashed out. However, some Awards allow this option under very specific conditions. Review your Award or Enterprise Agreement to check if an employee can request to have Personal Leave Cashed Out;

- Long Service Leave – only South Australia, Tasmania and Western Australia allow cashing out of Long Service Leave. If the employee that applies for Leave Cash out resides in one of these states, please review the conditions stipulated in your State’s Long Service Leave Act to pay this entitlement correctly;

- RDO and Time Off in Lieu – can be cashed out at any time.

The way Leave Cash Out is reported through STP varies by the type of Leave:

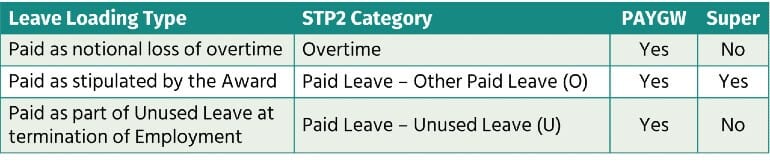

The Fine Prints – Leave Loading

Leave Loading can be payable to an employee for two reasons:

- the employee is required to work overtime from time to time. Leave loading is paid due to ‘a notional loss of opportunity to work overtime’.

- the employee never works overtime however, he/she is still entitled to receive Leave Loading, as per the conditions of their classified Award.

The way Leave Loading is reported through STP varies:

Bonuses & Commissions

Under STP Phase 2, Bonus and Commission payments must also be reported using a separate STP Category called Bonuses and Commissions. However, this category does not include all Bonus Payments.

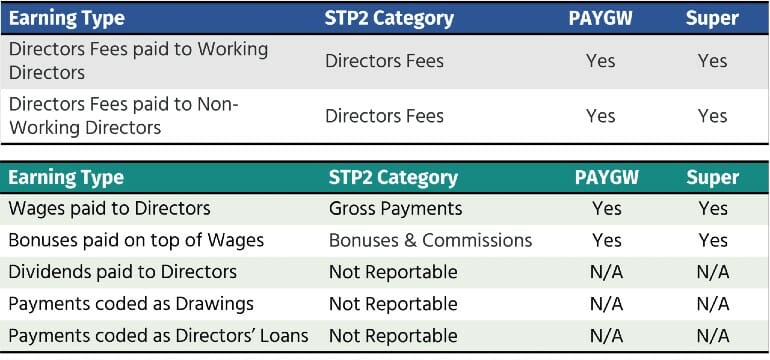

Directors Fees

The final STP Phase 2 reporting category disaggregated from Gross Payments is Directors Fees. Once again, not all payments to Directors are reported under this STP category. Business Owners should consult their Tax Advisors for the correct reporting and tax treatment of all types of payments made to Directors.

Disaggregation of Gross Earnings – Allowances

An Allowance is a payment made to an employee, in addition to their regular salary, and compensates them for completing certain tasks, working in specific locations, using special skills or reimbursing expenses incurred whilst performing their duties.

There is a range of Allowances included in the different Awards and Enterprise Agreements, however from the tax perspective, the ATO classifies Allowances into four types:

- Allowances paid for Working Conditions

These Allowances cover additional payments made to employees for working under special conditions, for example, danger, height or dirt.

These allowances are subject to both PAYGW and Superannuation. - Allowances paid for Qualifications or Special Duties

These Allowances cover additional payments made to employees for obtaining specific qualifications or for covering special duties (for example, First Aid or Leading Hand Allowance).

These allowances are subject to both PAYGW and Superannuation.

- Allowances paid to cover Deductible Expenses

These are Allowances paid to employees to cover tax claimable work-related expenses (for example travel from site to site, or cleaning work uniforms).

When employees are paid allowances for deductible expenses, they are not required to keep receipts for these purchases.

The ATO sets up a reasonable amount for most of these allowances defined as ‘the ATO measure‘. The ATO measure is reviewed each year and amended when required.- When these allowances are paid up to the ATO measure, they are exempt from both PAYGW and Superannuation.

- When the payment of these types of allowances is above the ATO measure, or when there is no applicable ATO measure, then the full amount of the allowance is taxed.

- If there is a reasonable expectation that the employee will use the full allowance payment towards the relevant expense, the allowance is still exempt from Superannuation.

- If there is not a reasonable expectation that the employee will use the full allowance payment towards the relevant expense, the allowance is subject to Superannuation.

- Allowances paid to cover Non-Deductible Expenses

These are Allowances paid to employees to cover non-tax claimable work-related expenses (for example travel from home to site, or cleaning work clothes that are not deemed as uniforms). When an allowance is paid for a non-tax deductible expense, it is subject to both PAYGW and Superannuation, regardless of the amount paid to the employee. The ATO measure does not apply to non-deductible expense allowances.

In addition to allowances, employers may also make additional payments to employees that are not classified as Allowances and therefore not reportable under STP.

- FBT Expenses

These types of payments are made to compensate employees for incurring non-tax claimable work-related expenses that are subject to FBT (for example LAFHA – Living Away from Home Allowance). These payments are exempt from the definition of assessable income for Social Security purposes and from both PAYGW and Superannuation. However, they are subject to Fringe Benefits Tax (FBT). - Expense Reimbursements

These are payments made to employees to reimburse them for out-of-pocket expenses incurred. An employee is required to keep receipts for these purchases and hand them over to the employer to be reimbursed.

As the out-of-pocket expense has been reimbursed, the employee cannot claim the expense as tax-deductible in their individual income tax return.

However, the Employer can claim both the GST and Income Tax on these expenses (providing the type of expense reimbursed is deductible for either GST or Income Tax).

Disaggregation of Allowances under STP Phase 2

Under STP Phase 2 the ATO classifies Allowances into:

- Nine STP Categories

- One of the nine Categories OD Other Allowances, is further itemised into six sub-categories defined as ‘Description Types’

The nine STP Categories applicable to Allowances are:

KN Task Allowances (Working Conditions)

This allowance type includes payments to employees for working under certain conditions. These allowances are often determined by an Industrial Instrument (Award or Enterprise Agreement) and they include:

- Supervisor/Leading Hand/Higher duties;

- Danger, Height or Dirt;

- Site Allowances;

- First Aid Allowances;

QN Qualification and Certification Allowances (Qualification or Special Duties)

This allowance type includes payments for employees obtaining and maintaining certain qualifications to perform their job. These allowances are often determined by an Industrial Instrument (Award or Enterprise Agreement) and they include:

- Certificate of currency;

- Liquor License;

- Certificate of Insurance;

- Professional Registration;

TN Tool Allowance (Deductible Expenses)

This allowance type includes payments to employees for using or maintaining tools for work, including:

- Tool Allowances (as determined by an Award);

- Phone Allowances;

Tool Allowances are taxed but exempt from Superannuation.

AD Award Transport Payments (Deductible Expenses)

This allowance type includes payments made to cover transport costs an employee may incur in the course of performing work duties only when this allowance is paid under an Industrial Instrument in force on 29 October 1986.

Transport allowances paid for business trips using public transportation including ticket fares and Uber/Taxis must be reported as OD Other Allowances – T1 Transport/fares

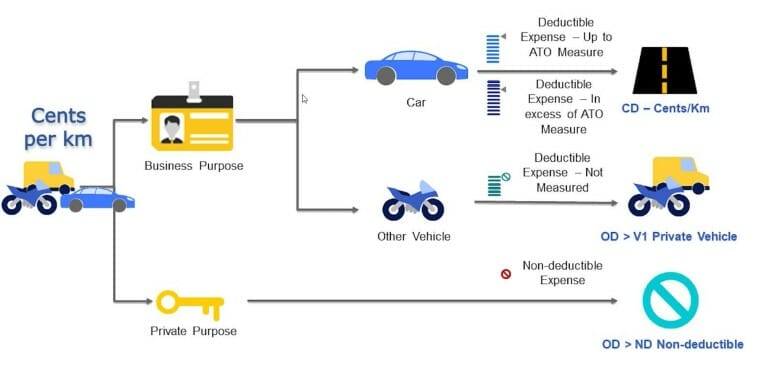

CD Cents per KM (Deductible Expenses)

This allowance type includes payments for km run using a personal vehicle for business purposes.

LD Laundry Allowances (Deductible Expenses)

This allowance type includes payments for laundering a compulsory uniform, a non-compulsory registered uniform or protective clothing.

MD Overtime Meal Allowances (Deductible Expenses)

This allowance type includes payments of overtime meal allowances only when paid above the ATO measure.

RD Domestic or Overseas Travel (Deductible Expenses)

This allowance type includes payments of overnight travel for meals and incidentals and local (Australian) accommodation only when paid above the ATO measure.

Overseas accommodation allowances are reported under OD Other Allowances – G1 General.

OD Other Allowances (Non-Deductible Expenses)

Under Other Allowance the ATO has included the following Description Types:

- G1 General

- H1 Home Office

- ND Non-deductible

- T1 Transport/fares

- U1 Uniform

- V1 Private Vehicles

Determine the correct STP Category for Allowances

The important aspect of assigning the correct STP Category to the relevant allowance is to identify the correct purpose of the allowance payment (why the allowance is being paid to an employee). The following examples provide some insights into the process of correctly reporting Allowances under STP Phase 2.

The Fine Prints – Motor Vehicle Allowances

There are a number of ways an employer can pay Motor Vehicle allowances. These could be:

- A nominal amount per pay period

a) the employee uses a personal car for work purposes and travels between the office and various sites. The amount paid over each pay period has been estimated to cover the running costs of the car including registration, insurance, petrol and maintenance. In this instance, the Motor Vehicle Allowance is reported as OD Other Allowances – V1 Private Vehicle. As there is no applicable ATO measure, the Allowance is taxed but exempt from Superannuation.

b) the employee uses a personal car to travel from home to work. As the Home from/to Work trip is considered private use of the car, this allowance is reported as OD Other Allowances – ND Non-Deductible. The Allowance is taxed and subject to Superannuation. - A lump sum (generally per year)

a) the employee uses a personal car for work purposes and travels between the office and various sites. The amount paid over the year has been estimated to cover the running costs of the car including registration, insurance, petrol and maintenance. In this instance, the Motor Vehicle Allowance is reported as OD Other Allowances – V1 Private Vehicle. As there is no applicable ATO measure, the Allowance is taxed but exempt from Superannuation.

b) the employee is paid an Annual Car Allowance however the car is not used for work at all (except for travelling to and from work). In this instance, the lump paid is reported as OD Other Allowances – ND Non-Deductible. - Cents per km

a) an employee is paid cents per km to use their personal vehicle and travel from the Office to the various sites. In this instance, the allowance is reported under CD – Cents per Kilometre.

However, in the instance the employee is paid cents per Km driving a personal Van or Motorbike, the allowance is reported as OD Other Allowances – V1 Private Vehicle.

The amount paid up to the ATO measure (for FY 2023 0.75c per Km up to 5,000 km per year) is exempt from both PAYGW and Superannuation. Any amounts paid above the ATO measures are taxed but still exempt from Superannuation.

b) an employee is paid cents per km to use their personal vehicle and travel from home to the office. As this travel type is deemed private, the allowance is reported as OD Other Allowances – ND Non-Deductible. The Allowance is taxed and subject to Superannuation.

The Fine Prints – Laundry & Uniform Allowances

Laundry Allowance is often confused with Uniform Allowance. A Laundry Allowance is an allowance paid to an employee to wash specific types of clothes used at work. A uniform allowance is a payment made to an employee for purchasing clothing for work purposes. More information on the ability to claim Clothing and Laundry costs is available on the ATO website.

Therefore, when the allowance is paid to purchase clothing for work purposes, under STP Phase 2, this is reported as OD Other Allowances – U1 Uniform.

a) The Allowance is paid to launder clothes not used at work (private) this is reported as OD Other Allowances – ND Non-Deductible.

b) The Allowance is paid to launder clothes used at work, the correct reporting option depends on the type of clothing:

- Conventional Clothing > OD Other Allowances – G1 General

- Occupational Specific Clothing > LD Laundry Allowances

- Protective Clothing > LD Laundry Allowances

- Compulsory Uniform > LD Laundry Allowances

- Non-compulsory Registered Uniform > LD Laundry Allowances

- Non-compulsory Not Registered Uniform > OD Other Allowances – G1 General

When the allowance is reported under the LD Laundry Allowance STP reporting category, the ATO has a set annual measure of $150 per year. Payments up to the ATO Measure are exempt from both PAYGW and Superannuation. Payments reported as LD Laundry allowances above $150 per annum must be taxed (but still exempt from Superannuation).

All other types of Laundry Allowance Payments reported under OD Other Allowances must be taxed (still exempt from Super).

The Fine Prints – Meal Allowances

Meal Allowances can be paid to employees in the following instances:

- Meal Allowance paid for lunch at work

a) The employer decides to pay their employees a meal allowance, as on occasion they are called into work during their lunch break. In this instance, the allowance is reported as OD Other Allowances – ND Non-Deductible

b) The employer pays a meal allowance to employees who travel for work in the metropolitan area.

As the travel is around the metropolitan area and the employee is returning to the Office (or home) at the end of the working day, the allowance is reported as OD Other Allowances – ND Non-Deductible - Meal Allowances paid for Overnight Travel

If the allowance is paid during a business trip where the travel is regional, interstate or international and the employee stays (or intends to stay) overnight, then the allowance is not reported through Single Touch Payroll if the amount is paid up to the Overnight Travel Allowance ATO rates. If paid above the Overnight Travel Allowance ATO rates, then the entire amount is reported as RD Domestic or Overseas Travel Allowance - Meal Allowance paid for Overtime

If an employee works 10 hours or more, under some Award, they may be entitled to a Meal Overtime Allowance. If this allowance is paid up to the ATO measure then it is not reported through Single Touch Payroll. If it is paid above the ATO measure then it is reported as MD – Overtime Meal Allowance.

Disaggregation of Gross Earnings – Compound Earnings

With STP Phase 2 the ATO will also require employers to disaggregate compound Award Rates and also Salary Packages, depending on how the employment agreement is drafted.

Disaggregation of Salary Packages

When a Salary Package details the amount of each Salary Components (such as Overtime or Allowances), under STP Phase 2 this type of Salary Package needs to be disaggregated and reported under the relevant STP categories.

Note: the ATO clarifies that ‘detailed Salary Components’ refers to the Salary components being determined by dollar values, not hours or other non-monetary descriptions.

Disaggregation of Compound Rates

An all-purpose rate, or compound rate, is a rate determined in some Awards. This rate includes both the Base Rate for Ordinary Hours of Work (or Overtime) and one or more types of Industry Allowances. It is important to emphasise that the allowance components incorporated in the all-purpose rates are also included in the calculation of both shift penalties and overtime.

Under STP Phase 2, compound rates will need to be disaggregated following these guidelines:

- OTE Base Rate > The base pay rate should be separated from the Allowance components and each allowance component reported separately under the relevant STP Reporting Category.

- OTE Shift Penalty Rates > Similar to the Base Rate the pay rate loaded by the penalty should be separated from the loaded Allowance components. Each loaded Allowance component should be reported separately under the relevant STP Reporting Category.

- Overtime Rates > Both the Base Rate and Allowance components must be reported as Overtime.

Conclusions

The key driver for the changes included as part of the second phase of Single Touch Payroll is the ability to correctly determine assessable income for Social Security purposes.

To achieve this goal, the ATO has introduced a much more detailed way of reporting the different pay categories through Single Touch Payroll.

The process of Disaggregation of Gross Earnings represents the most complex task involved as part of this new phase. This new detailed way of reporting brings to the surface the true complexity of Payroll in Australia.

Australian Employers should carefully review their payroll structure and ensure this is set up to report correctly under STP Phase 2. It is also time for them to think about outsourcing this complex task to a professional and avoid the risk of breaching compliance.

References

Disclaimer

This blog and attached resources are of general nature designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.