The True Cost of Fringe Benefits to Employers

By Paolo, 28.12.2023

The words “Fringe Benefits” and “Fringe Benefits Tax” are usually obscure concepts for Small Business Owners, who often think Fringe Benefits only apply to large enterprises. Most Bookkeepers tend to decline to discuss the topic, claiming that Fringe Benefits is the Accountant’s responsibility.

Although the task of registering and calculating Fringe Benefits Tax is a dedicated skill for Accountants/Tax Agents, it is important for both Small Business Owners and their Bookkeepers to understand what fringe benefits are, how they are taxed, and their reporting requirements.

This blog article has been developed to help Small Business Owners gain a general understanding of Fringe Benefits and their true cost.

What is a Fringe Benefit

A Fringe Benefit is a form of non-monetary compensation provided to employees on top of their wages and salaries. The terms ‘Benefit’ and ‘Fringe Benefit’ have a broad meaning, encompassing rights, privileges and services.

Examples of Fringe Benefits include:

- Allowing an employee to use the company car for personal use;

- Paying for an employee’s private car park at work;

- Giving an employee a discounted loan or forfeiting their loan outstanding balance;

- Giving an employee a discounted item or service the business sells to its customers;

- Paying the employee’s rent or utility bills;

- Paying the employee’s gym or social club membership;

- Paying the employee’s private health insurance;

- Paying the employee’s childcare or school fees;

- Giving benefits under a salary sacrifice arrangement;

- Providing entertainment or gifts to an employee.

Small Business Owners may feel pressured to offer non-monetary benefits when negotiating salaries in an effort to attract or retain talent without understanding their true cost and tax implications.

The financial consequence of giving Fringe Benefits to employees for employers may be the requirement to register and pay Fringe Benefits Tax or FBT to the ATO.

Understanding Fringe Benefits Tax

Fringe Benefits Tax is an employer’s tax calculated on the taxable value of the fringe benefits provided to employees.

As of FY 2024, the applicable rate of Fringe Benefits Tax is 47% of the taxable value of the fringe benefit.

This means that when employers provide fringe benefits to employees, they may have to pay an additional 47% Fringe Benefits Tax on such benefits.

The ATO introduced the Fringe Benefits Tax Assessment Act in 1986 in response to an increased number of employers attempting to circumvent paying PAYG by providing non-monetary benefits to their employees in lieu of wages and salaries.

The purpose of the Fringe Benefits Tax legislation is for the ATO to receive the same tax they would receive if the employer paid the equivalent value of the benefit to the employees by way of salary and wages. To ensure this, the ATO set the FBT rate to the highest PAYG tax bracket, regardless of what tax bracket the employee’s annual wages are currently calculated on.

Once an employer provides fringe benefits to employees, the company Tax Accountant is responsible for assessing the Fringe Benefits Tax implication for the benefits provided and, if required, taking the following actions:

- registering the business for Fringe Benefits Tax;

- calculating the taxable value of the fringe benefits provided;

- calculating the fringe benefits tax liability;

- lodging the FBT return at the end of each FBT year, and finally

- calculating any applicable Reportable Fringe Benefits Amounts (RFBA) and providing them to the company’s Bookkeepers/BAS Agents to include in the employees’ Income Statements at the end of the Financial Year.

The FBT year falls on a different period than the Financial Year. It runs from the 1st of April till the 31st of March. Businesses are required to lodge their FBT return by May 21st each year.

It is important to understand that a non-monetary benefit is only deemed as a Fringe Benefit when given to an employee (including Company Directors) or an employee’s family member (defined as ‘Associate’). When benefits are given to customers, suppliers and even sub-contractors, these are not deemed fringe benefits. Volunteers and Sole Traders are also exempt from FBT.

For example, a business owner purchases two $500 champagne bottles as a gift to celebrate a lucrative deal. He gives one bottle to the client who signed the contract and one to his sales consultant who facilitated the deal. In this instance, FBT only applies to the champagne bottle gifted to the Sales Consultant, as this is the business employee.

What is the true cost of Fringe Benefits?

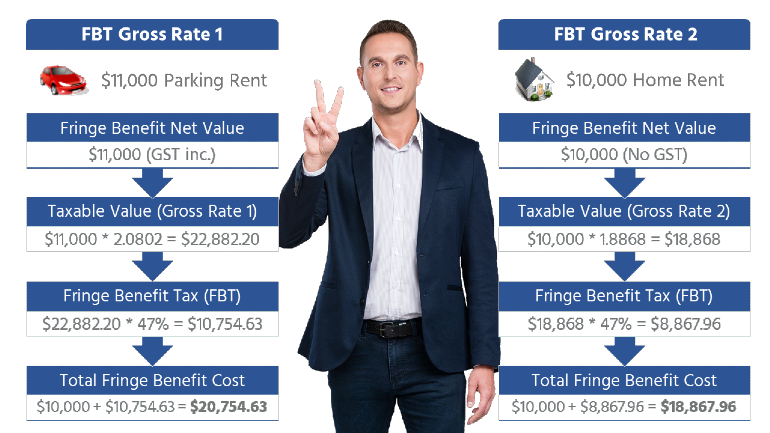

As the purpose of the FBT legislation is for the ATO to receive the same tax they would withhold from gross wages, the taxable value of the benefit is calculated by “grossing up” the cost of the benefit. The ATO provides two rate types:

- type 1 > applicable to benefits that include GST. This is currently 2.0802;

- type 2 > applicable to GST-exempt benefits or businesses that are not registered for GST. This is currently 1.8868.

FBT Grossed Up Rate Type 1 Example

An employer decides to pay rent for a commercial car park to an employee located in their Sydney CBD office building. The total annual rent is $11,000 per year (inclusive of GST).

The taxable value of the Fringe Benefit is calculated as $11,000 * 2.0802 = $22,882.20.

FBT is calculated as 47% of $22,882.20 = $10,754.63.

Therefore, the total cost of the Cark Park fringe benefit to the employer is made up of the $10,000 Car Park rent (excluding GST) + $10,754.63 FBT = $20,754.63.

The business will recover the $1,000 GST credit once lodging the Business Activity Statement.

FBT Grossed Up Rate Type 2 Example

An employer decides to contribute $10,000 per annum towards an employee’s residential rent.

As residential rent does not have GST, the fringe benefits taxable value is calculated as $10,000 * 1.8868 = $18,868

FBT is calculated as 47% of $18,868 = $8,867.96

Therefore, the total cost of the rent contribution Fringe Benefit to the employer is made up of the $10,000 rent contribution + $8,867.96 FBT = $18,867.96.

The next issue to consider is whether the provision of a Fringe Benefit is a smarter tax strategy than paying the equivalent benefit value as gross wages.

One of the key factors is the annual gross wages the employee is earning before the value of the fringe benefit is taken into consideration.

Expanding on the example of the $10,000 rent contribution, which resulted in a total employer’s cost of $18,867.96, once adding the FBT component, two options will be reviewed.

Option 1: the employee earns $70,000 per annum

Currently, the employee’s tax bracket sits at 32.5% (plus a 2% Medicare Levy).

The current employee’s after tax wages are $55,383.

- If the additional $10,000 net rent contribution were to be offered as part of wages, the employer would need to add an extra $18,267 in gross wages.

This would bring the total gross wages (inclusive of the rent contribution) to $85,268 + 11% Super = $94,647.48. - If the Employer were to offer the rent contribution as a fringe benefit, the total cost would be: $70,000 + 11% Super = $77,700 + $18,867.96 = $96,567.96.

In this example, the employer is better off by providing the grossed-up value of the Fringe Benefit as Salaries and Wages.

Option 2: the employee earns $180,000 per annum

The employee’s tax bracket has gone to the maximum tax bracket of 47%.

The current employee’s after tax wages are $124,733.

- If the additional $10,000 net rent contribution were to be offered as part of wages, the employer would need to add an extra $18,868 in gross wages.

This would bring the total gross wages (inclusive of the rent contribution) to $198,868 + 11% Super = $220,743.48. - If the Employer were to offer the rent contribution as a fringe benefit, the total cost would be: $180,000 + 11% Super = $199,800 + $18,867.96 = $218,667.96.

In this example, the employer is better off by providing the Fringe Benefit directly to the employee.

Based on the examples provided, giving an employee a Fringe Benefit is a more effective tax strategy when the benefits are offered to employees already earning the maximum tax bracket, as superannuation is not calculated on fringe benefits.

However, business owners should also consider the additional hidden costs and compliance requirements applicable to Fringe Benefits Tax. Therefore, employers should always seek advice from their Accountant/Tax Agent and discuss the best tax strategy prior to offering fringe benefits to their employees.

FBT Exemptions

Some benefits given to employees may also be exempt from Fringe Benefits Tax. The FBT legislation details a range of exemptions, including certain items, items’ value, vehicles and specific types of Not-for-profit organisations.

The most common FBT exemptions are:

Purchasing of protective clothing and tools of the trade

When employers provide protective clothing and tools for the trade, these items are always exempt from FBT.

Purchasing of hand-held electronic devices

Employers can purchase a range of hand-held electronic devices for their employees, including smartphones, tablets and laptops.

These items are exempt from FBT when they meet the following conditions:

- the limit to purchase one item per FBT year with substantially identical functions, unless it is a replacement item.

Note: some exemptions apply for businesses with a turnover under $50 million; - at least 50% of the usage of the item must be for work purposes.

Refer to the ATO Webpage: Work-related items exempt from FBT

Pre-Tax Superannuation Contributions

Voluntary pre-tax superannuation contributions, including both employees’ salary sacrifice arrangements and employer additional super contributions, are exempt from FBT.

Refer to the ATO Webpage: Salary Sacrificing

Employees’ Recognition Awards

The following benefits purchased in recognition of employees’ work are also FBT-exempt:

Safety Awards

These awards are given to employees to acknowledge the importance of maintaining a safe workplace, emphasising the value the company places on a healthy environment.

Safety Awards benefits of up to $200 per employee per FBT year are exempt from FBT.

Long Service Awards

These awards are given to employees to recognise significant workplace milestones.

Long Service Awards paid to employees after 15 years of service are FBT exempt when limited to the value of $1,000, plus $100 for each year of service exceeding 15 years.

Refer to the ATO Community Webpage: Long service staff gifts & FBT

Employees’ Relocation Costs

Employers are exempt from FBT when covering the cost of relocation for any employee required to relocate to a new residence or live away from home to carry out work.

Relocation expenses include:

- transport by employee’s car;

- temporary accommodation;

- meals.

Refer to the ATO Webpage: Relocation expenses fringe benefits concession

Purchasing of work vehicles

The following vehicle types are exempt from FBT when the use for private needs is limited:

- a single cab ute;

- a duel cab ute designed to either:

- carry a load of 1 tonne or more;

- carry more than 8 passengers (including the driver);

- carry a load of less than 1 tonne but not designed for the principal purpose of carrying passengers);

- a panel van or goods van;

- a taxi;

- any 4-wheel drive designed to either:

- carry a load of 1 tonne or more;

- carry more than 8 passengers (including the driver);

The ATO only includes the following private trips as part of the “limited private use” available to work vehicles:

- travel between home and work;

- any diversion to home and work travel within 2 km;

- any incidental travel in the course of employment;

- any personal travel limited to 200 km per trip for a maximum total of 1,000 km private use per year.

Refer to the ATO Webpage: Vehicles eligible for exemption

Purchasing of electric vehicles

This exemption started on 1 July 2022 and applies exclusively to electric vehicles held and used from 1 July 2022.

The following vehicle types meet the eligibility criteria:

- cars with zero or low emissions vehicle, including:

- battery electric vehicles;

- hydrogen fuel electric vehicles, and

- plug-in hybrid electric vehicles

The FBT exemption on hybrid electric vehicles expires on April 1, 2025.

- cars whose value falls under the fuel-efficient Luxury Car Threshold for the Financial Year where the vehicle was purchased;

- cars designed to carry a load of less than 1 tonne;

- cars designed for fewer than 9 passengers.

Refer to the ATO Webpage: Electric cars exemption

The Relationship between motor vehicles and individual taxpayers and motor vehicles and companies includes a number of complex legislations. Company Directors and Trust owners, in particular, should seek advice from their Accountant before purchasing their vehicle and decide with their Tax Agent if they are better off buying the vehicle under their personal or company name. Finally, agree on the most tax-effective way to claim motor vehicle expenses as a tax deduction.

Minor Benefits Exemption

Purchases of items and entertainment under $300 (GST inclusive) per head, per instance, are exempt from FBT. Providing that these purchases are ‘infrequent’ and ‘irregular’.

It is important to note that the ATO does not provide any guidelines outlining the number of times the same benefit type can be provided to an employee (or their associates) before it’s regarded as ‘frequent’ or ‘regular’. However, the ATO does state that anniversaries, birthdays, and holidays are excluded from the definition of ‘regular events’.

Refer to the ATO Webpage: Minor benefits exemption

Property Exemption

Entertainment provided exclusively to employees during office hours and on office premises is also exempt from FBT.

For more information about the provision of gifts and entertainment to employees, customers, and suppliers, refer to the following blog published on our website: Tax implications on meals, gifts and entertainment.

FBT Exempt Organisations

Some Not-for-profit Organisations can access an FBT exemption applicable to all their employees. The FBT liability is removed from the gross amount of FBT payable to employees up to a set annual cap, allowing these organisations to offer non-salary benefits to employees (for example, paying for their residential rent, car loans or credit card debt).

The cap varies between different types of organisations:

- Registered Public Benevolent Institutions and Registered Health Promotion Charities receive an FBT exemption up to a $30,000 annual cap per employee;

- Public, Not-for-profit hospitals and ambulance services receive an FBT exemption up to a $17,000 annual cap per employee;

- Religious institutions receive an FBT exemption up to a $30,000 annual cap per employee. Additional FBT concessions apply to their religious practitioners, live-in residential carers and domestic employees.

Note: Religious institutions also receive FBT exemptions from car parking payment benefits or car parking spaces provided to their employees.

Refer to the ATO Webpage: Types of charities

For more information about other FBT exemptions, refer to the ATO website.

How does FBT impact other Tax Liabilities?

Once a business is registered for FBT, as well as reporting and paying FBT correctly, it also needs to take into account the impact of FBT on other Tax liabilities.

GST

Purchases of Fringe Benefits items subject to GST

The Tax Office has two rulings to assist with understanding the relationship between FBT and GST. These are:

- GSTR 2001/3 is the current authority for the impact of GST on fringe benefits;

- TR 2001/2 provides the two applicable grossed-up rates for benefits that include or are exempt from GST.

When an item that includes GST is purchased as a fringe benefit, the business can still claim the GST credit on the purchase of such item. However, the calculation of the FBT taxable value is grossed up by a higher rate (Rate Type 1, 2.0802), as previously detailed in this blog article.

Claiming a GST credit for entertainment expenses

Businesses not registered for FBT cannot claim the GST credit for entertainment expenses (i.e. catering, drinks, etc.) or gifts with a nature of entertainment (i.e. domestic flights, concert tickets, etc) even when the expense includes GST.

However, once registered for FBT, businesses can choose to claim the GST credit but pay FBT on these expenses.

Income Tax

FBT as an Income Tax deductible cost

The fringe benefits tax amount payable to the ATO each year in the FBT Return is income tax-deductible. This means that any FBT paid to the ATO reduces the Business Income Tax liability for the relevant Financial Year.

Claiming entertainment expenses as Income Tax deductible costs

Businesses not registered for FBT cannot claim any entertainment expenses (i.e. catering, drinks, etc.) or gifts with a nature of entertainment (i.e. domestic flights, concert tickets, etc) as an Income Tax deductible expense.

However, once registered for FBT, businesses can choose to claim these expenses as Income Tax deductible but pay FBT on them.

Payroll Tax

Any Fringe Benefits claimed in the FBT return is subject to Payroll Tax.

The calculation of the Payroll Tax liability on fringe benefits does not recognise the FBT Grossed Up Rate Type 1. The Payroll Tax Liability is calculated by summing up the net value of the FBT benefits declared in both Type 1 and Type 2 of the FBT Return and grossing up this total by Type 2 only (1.8868).

Businesses who report Payroll Tax monthly should include 1/12 of the calculated FBT Payroll Tax amount reported in the FBT return immediately prior to the current Financial Year as their monthly FBT estimate.

When lodging the Payroll Tax Annual declaration in July, they must use the FBT values lodged in the latest FBT Return (generally lodged a couple of months prior to the Payroll Tax Annual Declaration) as the actual FBT Payroll Tax value for the Financial Year.

Reporting FBT on Employees’ Income Statements

The final FBT compliance requirement for Employers is to include the grossed-up value of the employee’s Fringe Benefits (or RFBA) from the previous FBT year on their Income Statements (previously known as Payment Summaries or Group Certificates).

Although the value of Fringe Benefits does not have an impact on the individual’s income tax, it does increase the employees’ assessable income applicable to other Government benefits and obligations, including:

- welfare benefits;

- child support;

- Medicare levies;

- private health insurance rebates;

- Superannuation tax and co-contributions;

- repayments of Study and Training Support Loans (STSL), and

- other individual tax thresholds and concessions.

The employees’ Income Statements include two RFBA options:

- RFBA > include all grossed-up FBT amounts paid to non-FBT-Exempt organisations exceeding $2,000 total net fringe benefit per employee;

- RFBA under Section 57A of the Fringe Benefits Tax Assessment Act 1986 (FBTAA 1986) > include all grossed-up FBT amounts applicable to FBT-Exempt Organisations exceeding $2,000 total net fringe benefit per employee.

Similar to Payroll Tax, the grossed-up calculation of RFBA only applies to the grossed-up type 2 rate (1.8868).

Clashes between FBT Year and Financial Year when reporting RFBA

Employers should also be mindful of the period clashes between the FBT Year and the Financial Year.

This may affect the following terminated employees:

Employees receiving fringe benefits terminated between April and June

Employees receiving fringe benefits from employers could receive an additional Income Statement from their previous employer the Financial Year after their employment terminated, if such termination happened between April and June.

This Income Statement would only include RFBA values from the period between April and June whilst they were still working for their previous employer.

For example, Jane worked as a Project Manager for ABC Software Development based in Sydney CBD.

She received a commercial car parking space rented by the company for $1,000 per month.

On 15 June 2022, Jane left ABC Software Development.

By 14 July 2022, she received her FY 2022 Income Statements, which included her taxable income for FY 2022 and the grossed-up FBT amount for the car parking rent from April 2021 to March 2022.

By 14 July 2023, Jane will receive two Income Statements, one from her current employer, including her taxable income (and any applicable Fringe Benefits she may have negotiated with her new employer) and one from her previous employer, ABC Software Development.

This last Income Statement will only include the RFBA grossed-up values for the rent of the parking space from April 2022 to June 2022.

As the rent for the parking space is $1,000 per month, the total pre-grossed fringe benefit value for 2.5 months exceeds $2,000. Therefore, ABC Software Development is required to issue an Income Statement even if Jane has not worked for their business in FY 2023.

As Jane is repaying her STSL debt, which is withheld from her pay, the RFBA values reported by ABC Software Development will affect her STSL repayment calculations in FY 2023.

Employees terminated during the Financial Year who lodged their Income Tax Return before the 14th of July

Employees receiving Fringe Benefits from their previous employers should wait until they receive a finalised copy of their Income Statement by the 14th of July before lodging their Individual Tax Return.

This is an issue with Single Touch Reporting in some Payroll software applications. When an employee is terminated, the software application automatically flags the Income Statement in the employee’s MyGov account as Final. This can be misleading for some employees who may rush to lodge their tax returns.

By the end of the Financial Year, their previous employer may be required to add the grossed-up values of their employee’s fringe benefits received in the previous FBT year, which could affect some of the employee’s other Government benefits and obligations.

Therefore, these employees should wait until the 14th of July before finalising their personal Income Tax return.

Conclusions

Agreeing to pay certain benefits to employees may come at a much higher cost and involve a lot more responsibilities than an employer may anticipate.

Small Business owners should seek advice from their Accountants when they plan to offer certain benefits to either attract or retain talent for their workplace.

References

https://www.legislation.gov.au/Details/C2014C00048

https://www.revenue.nsw.gov.au/taxes-duties-levies-royalties/payroll-tax/wages/fringe-benefits