What changed in my Pay Slip? and Why?

By Paolo, 14.07.2024

A pay slip, also called “pay advice,” is a legal document that summarizes an employee’s pay for a particular pay period.

Aside from being a legal document, the information included on pay slips is also essential in the event of employees’ disputes over their pay.

Although the core information included in pay slips has not changed since the introduction of Fair Work in 2009, employees have probably noticed a number of recent changes to the way the information is presented and to their pay.

These changes are the result of a number of regulation amendments that have occurred over the past few years.

In this blog, we will explore the changes to the way information is presented on pay slips and the more recent amendments to the employees’ pay.

However, before reviewing these changes, we will provide an overview of the key information pay slips must provide, as well as dispel some of the common myths about whether certain information should be included in them.

Pay Slips Obligations for Employers and Employees

Employers Obligations

Employers must provide their employees with a legally compliant pay slip within 24 hours of the pay date for each pay period.

Failure to provide pay slips to employees may result in the Fair Work Ombudsman imposing penalties or taking employers to court when failure to meet the requirements is deemed ‘serious’, willful’ or ‘repetitive’.

There is no set way to provide pay slips. This can be done by hand, post, or electronically via email, or by simply making them available through a secure portal.

Employers should be aware that the privacy laws applicable to any documents containing sensitive information also apply to pay slips.

When pay slips are provided by hand, they should be personally handed over to the employee in sealed envelopes. They should never be placed on unattended employees’ desks and at risk of being viewed by others.

When pay slips are provided via email, employers should include, as part of the onboarding process, a signed request for authority to send pay slips to the email address provided in the employment forms.

When pay slips are available through a portal, employers should ensure that access to the portal is secure and that other employees cannot access the information.

Although pay slips are private and confidential, there may be some circumstances where employers are required by law to provide them to a third party, such as a government agency.

Employees Obligations

Employees must provide specific details (including their tax position, superannuation fund, and bank details) as part of their onboarding process so that their employer can pay their wages and entitlements correctly and on time. Some of this information is then displayed on their pay slips.

After the employees provide their key employment details at the time of engagement, they are still obligated to update their personal information, emergency contact details, superannuation and tax position whenever any of these change during the course of their employment.

Employees are not obligated to review their pay slips each time they are paid. Needless to say, except for employees paid the same salary regardless of the hours worked, they are strongly encouraged to review their pay slips to ensure that they have been paid correctly.

Pay Slips Information

Pay Slips Mandatory Information

Although pay slips can be presented in different ways, Section 536 of the Fair Work Act provides a list of core mandatory information to present.

A pay slip must include the following information:

- Employer’s and employee’s name;

- Employer’s ABN;

- Pay period (from and to dates) and pay date;

- Gross (before tax), tax withheld and net (after tax) pay (per pay period and YTD).

Note: when an employee is paid an hourly rate, the number of hours and hourly pay rates must also be displayed; - Any loadings, bonuses, penalty rates and allowances;

- Any deductions;

- Superannuation contributions (Super Guarantee, Additional Employer and Voluntary pre and after-tax employee contributions);

- the Employee’s Superannuation Fund details;

A pay slip must not include the following information:

- the employee’s Tax File Number;

- the employee’s full bank account details;

- the employee’s Family and Domestic Violence Leave balances;

Note: when the employee takes Family and Domestic Violence leave, the time taken must appear on the pay slip. However, it cannot be shown on the payslip with the name ‘Family and Domestic Violence Leave’. More information on how to manage this entitlement correctly is available on another blog published on our website.

Pay Slips Optional Information

A common question is whether leave balances should be displayed on pay slips. Fair Work is quite clear about this point. Employers have no obligation to show leave balances on pay slips. However, they must keep current and accurate records of Leave accruals and are required to inform their employees of their leave balances upon request.

As displaying leave balances is at the employer’s discretion, our personal recommendation for showing leave balances on the pay slip varies depending on the leave type:

- Annual Leave > We recommend our clients show these balances on pay slips. This will save both time and aggravation of having employees asking about their leave balances all the time;

- Personal/Carer’s Leave > We believe it’s best not to show these balances on pay slips. Personal/Carer’s Leave is an incidental leave. If an employee schedules a doctor’s appointment, this must be taken as Annual Leave. Furthermore, an employee who is not fit to work on a particular day (particularly when their job is deemed ‘high-risk’) should not force himself to come to work just because they have run out of Personal leave accruals. This could result in accidents on-site and the creation of an unsafe work environment.

- Long Service Leave > We strongly advise our clients against showing Long Service Leave balances on the pay slip due to the complex legislation surrounding this entitlement, which also changes for each state and territory.

Leave balances and leave taken are two distinctive things; whilst there is no obligation for employers to show leave balances on pay slips, it is compulsory to show any period of leave taken and relevant pay rates on the employees’ pay slips.

Changes to the Information Presented on Pay Slips

Now that we have covered the basics, we will review some key changes introduced to the way information is presented on pay slips implemented over the past few years.

Casual Loading

Casual Employment has been the subject of many debates and reform changes by both the previous and the current Labour Government, with further amendments being introduced as part of the Closing Loopholes Phase 2 Fair Work amendments in August 2024.

Although the various amendments have challenged and revised the definition of casual employment, the core issue has not changed: a worker is hired as a casual, but the patterns of work are of a permanent employee. This redefines the employee as ‘permanent casual’.

When this happens, the employee can make a ‘Casual Conversion’ request to the employer and change his employment from casual to permanent. Furthermore, the employee may also apply for back payment of leave entitlements for the period employed as a ‘permanent casual’.

As Casual Loading is paid to employees in recognition of their lack of entitlements, employers may deduct the total value of the casual loading paid from the back payment of entitlements under two conditions:

- The casual loading is detailed in the employment agreement, as paid to compensate the employee for the lack of entitlements received;

- The casual loading is clearly identifiable on the employee’s pay slip.

In some payroll systems, separating the Casual Loading is also an essential part of the payroll setup to ensure that Casual Overtime is correctly calculated for employees classified under certain Awards.

This means that casual employees’ pay slips may have changed to either show the Casual Loading as a separate line, or the Ordinary Hours pay item may have been renamed to acknowledge the Casual Loading as part of the pay.

It is essential to understand that this change should not be the reason for amending the employee’s pay rate. It is simply a different way to present the employee’s pay in order to safeguard the employer from doubling up on possible back payments of entitlements.

All-Purpose Allowances

Another recent change to the way information is presented on pay slips is the requirement to disaggregate the All-purpose Allowances from the Ordinary rate of pay. This change was introduced by the ATO in January 2023, as part of the second phase of Single Touch Payroll.

Employees classified under certain Awards (mostly Construction and Manufacturing-related Awards) receive specific allowances that are already included in their Ordinary Rate of Pay set out in the Award. These pay rates are defined as ‘Compound Rates’, meaning the minimum rates of pay are a combination of both pay rates and allowances.

All-purpose Allowances are assessed differently from the Ordinary Rate of pay when the individual income is assessed under the welfare system (including unemployment benefits and family support).

As the second phase of Single Touch Payroll extends the automatic reporting to the Welfare system, the ATO requires all compound rates to be “disaggregated”, meaning the pay rate components must be itemised separately on pay slips.

Similar to casual loading, this change is simply about presentation; it should not affect the actual amount paid to the employee. The sum of the base rate and all-purpose allowances itemised should equal the pay rate previously presented as one item.

Disaggregation only applies to Ordinary Hours of work. When the employee is paid overtime or any type of leave entitlements, the rate, all-purpose allowances, plus all applicable penalties, must all be reported as one item.

Unlike Casual Loading, this is a mandatory reporting change dictated by the Australian Taxation Office. Therefore, employers who still report compound rates as one item should review their payroll settings and disaggregate the pay rates accordingly.

Changes to Employee’s Pay

Information on pay slips is not the only thing that has changed recently. The Australian Government has also introduced a number of reforms that have significantly impacted employees’ pay, including:

1. Gross Pay Rates

All employees paid either the National Minimum Wage or the minimum pay rate set out by their Award Classifications should receive a pay increase each Financial Year as per the Annual Fair Work Wage Review. This increase applies to the first full pay period starting on or after the 1st of July.

The Fair Work Annual pay increase starting in July 2024 is 3.75%.

2. Individual Tax Rates

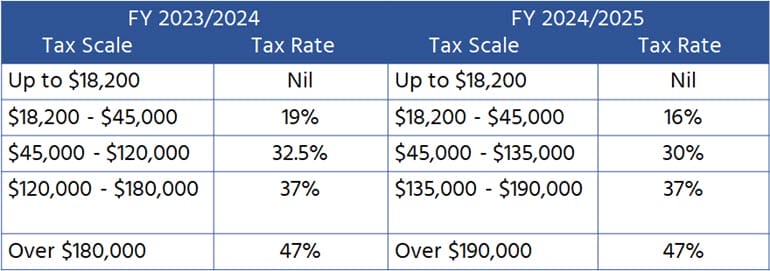

New individual tax rates have also been introduced from 1 July 2024, which will increase the employees’ net pay. The table below shows a comparison between the tax rates in the previous Financial Year and the new rates applicable from FY 2024/2025.

3. Superannuation Statutory Rate

The final change to employees’ pay is the Superannuation Statutory Rate, which is set to increase by 0.5% each Financial Year, from 9.5% in FY 2021 to 12% in FY 2026.

Conclusion

Pay Slips are essential legal documents to provide to employees.

Employers are required to issue compliant pay slips to employees as set out by the Fair Work Act and present information on the employees’ pay so that all elements of the pay are correctly reported to the Australian Taxation Office via Single Touch Payroll.

Finally, employers must ensure that all minimum wage and superannuation increases are applied to their employees’ pay and that new tax tables are used to calculate the correct tax deductions.

If ongoing payroll changes give you headaches, contact Evolution Cloud Accounting and receive ongoing support for your payroll and bookkeeping.

References

https://www.fairwork.gov.au/pay-and-wages/paying-wages/pay-slips

Disclaimer

This blog and attached resources are of general nature designed for informational and educational purposes only. They should not be construed as professional financial advice for your individual business. Should you need such advice, consult a licensed financial or tax advisor.