Understanding Public Holidays in Australia

By Paolo, 29.11.2023

A Public Holiday is a day, or part-day, established as a holiday either by the Australian Federal Government or by a state or territory. The Public Holiday may be set to celebrate a religious festivity (i.e. Christmas or Easter), a historical event (i.e. Australia Day or ANZAC Day) or a sporting activity (i.e. Melbourne Cup Day or Grand Final Day).

Public Holidays are deemed core employment entitlements and form part of the Fair Work National Employment Standards. This means all employees in Australia are entitled to take a paid day off from work on a Public Holiday.

However, Australian Businesses are still free to trade on most Public Holidays. Furthermore, retail and hospitality businesses located inside major shopping centres are required to trade on any Public Holiday where the Shopping Centre is open for business.

For employers, this creates the issue of needing their employees to work during these days and compensating them accordingly.

The intricacy of Australian Industrial Relations creates multiple levels of complexity by introducing a number of regulations set out across both Federal and state laws, which can make it difficult for employers to manage and pay Public Holidays correctly.

This blog article answers the key questions about managing, paying and rostering employees on Public Holidays.

Please note the rights and requirements outlined in this blog relate to Public Holiday entitlements stipulated by Fair Work and any other applicable Federal or state law. Additional entitlements offered by certain employers on top of the entitlements set out by the National Employment Standards may have different treatments explicitly outlined in an Employment Agreement.

What is the correct way to pay Public Holidays?

The correct way to pay Public Holidays varies depending on different factors, whether the business is open on Public Holidays, whether the employee is full-time, part-time or casual, and the employee’s classified Industry Award or Employment Agreement.

Businesses that trade Business Hours and are closed on Public Holidays

The payment of Public Holidays for Businesses that exclusively trade Monday to Friday and are always closed during Public Holidays is fairly straightforward. This also includes those businesses that trade Monday to Friday and occasionally work Saturdays as an additional ad-hoc trading day (where employees are always paid overtime).

Public Holidays are paid as follows:

- Salaried Employees > The salary paid to the employee does not change during any period that includes a Public Holiday;

- Full-time hourly employees > The public holiday is paid at the employee’s regular rate of pay (excluding any loadings, bonuses and some allowances);

- Part-time employees > The public holiday is paid at the employee’s regular rate of pay (excluding any loadings, bonuses and some allowances); providing the Public Holiday falls within a day, they are usually rostered to work.

- Casual employees > are not entitled to be paid Public Holidays.

Businesses that trade both weekdays and weekends but are closed on Public Holidays

Businesses that trade 6-7 days per week but are closed on Public Holidays must pay Public Holidays as follows:

- Salaried Employees > The salary paid to the employee does not change during any period that includes a Public Holiday;

- Full-time and Part-time hourly employees > The public holiday is paid at the employee’s regular rate of pay (excluding any loadings, bonuses and some allowances) or weekend penalty rate (when the Public Holidays falls on a weekend); providing the Public Holiday falls within a day they are usually rostered to work;

- Casual employees > are not entitled to be paid Public Holidays.

Businesses that trade both on Weekends and Public Holidays

Businesses that trade 6-7 days per week and on public holidays must review their employees’ Industry Award to correctly manage, roster and pay their staff during Public Holidays.

1. Requesting to work on Public Holidays

First, employers must request their employees to work on a Public Holiday. The request must either be traceable or documented. For example, the request could be made via a Rostering Software application, which the employee can accept or reject via the rostering app. For those employers that still use manual rosters, the request can be made by emailing the employee and requesting the acceptance (or refusal) to work in an email reply.

The employee can refuse the request to work, providing the refusal is reasonable. Although this is treated on a case-by-case basis, Fair Work provides the following guidelines to help an employer determine if the employee’s refusal is reasonable:

- The employee’s personal circumstances (i.e. family or caring responsibilities);

- The amount of notice given when the request was made;

- The nature of the employer’s workplace or enterprise;

- The employment type (full-time, part-time or casual);

- The needs of the business;

- Whether the requirement to work Public Holidays is part of the employment agreement;

- The history of previous requests to work Public Holidays.

In April 2023, the Federal Court ruled that the requirement to work Public Holidays outlined in an Employment Agreement is no longer sufficient to automatically roster an employee to work a Public Holiday. An individual request must be submitted to an employee each time the Employer requires them to work on a Public Holiday.

2. Paying or Substituting the Public Holiday

All employees (including casuals) who work on Public Holidays must be paid public holiday penalty rates. Alternatively, they may agree to substitute working the public holidays with an alternative day. The correct way to manage and pay this entitlement is stipulated in the employee’s classified Award and may include:

- the public holiday penalty rate applicable to permanent staff, casual employees and shiftworkers (as these often differ from each other);

- the minimum number of hours the employee must be rostered when working on a public holiday;

- the ability to substitute the public holiday worked with another day off (in agreement with the employee);

- the ability to substitute the public holiday worked with an extra day off or an extra Annual Leave day (in agreement with the employee).

Employers should carefully review the terms of their employee’s Award before initiating any substitution agreement or paying the incorrect penalty rate.

Can an employer alter a roster to avoid paying public holiday rates?

It is unlawful for an employer to intentionally alter a roster to avoid paying a public holiday to an employee. Any employers who operate rotating rosters for employees should review the employee’s work pattern over the 4 weeks preceding the Public Holiday to make a fair assessment of whether or not pay the Public Holiday.

Do employees receive super and accrue leave whilst absent on Public Holidays?

As the payment of Public Holidays is considered Ordinary Time Earnings, these payments attract Superannuation. Leave is also accrued during these periods.

What about those employees who are rostered to work on Public Holidays? Is their pay subject to Super and Leave?

Employees who are rostered to work on Public Holidays are also paid Ordinary Hours loaded by the Public Holiday penalty rate, providing that the public holiday worked falls on a regular day. Super is calculated on the full Public Holiday Penalty Rate. Annual Leave and Personal Carer’s Leave is accrued for all Full-time and Part-time employees. Long Service accruals apply to all employees.

When the Public Holiday worked day falls on additional day to the employee’s Ordinary Hours, or on a day deemed as Overtime by the Award, the Public Holiday rate is reported to the ATO as Overtime. In this instance, no super or leave accruals apply.

If an employee is rostered to work on a Saturday, and the Saturday is always paid as Overtime by the Award. What is the correct way to report and pay an employee working on a Saturday Public Holiday?

If the Saturday Public Holiday is substituted by another day by the relevant state or territory legislation, standard Saturday Overtime rates apply as set out in the Award. If the Saturday is still deemed a Public Holiday by the relevant state legislation (Addition or No Provision rules apply), then Public Holiday penalty rates apply. However, these must be reported as Overtime Earnings, not Ordinary Time Earnings. In this instance, no super or leave accruals apply.

When a Casual Employee is rostered to work on a Public Holiday, is the Casual Loading paid as part of the Public Holiday Penalty rate?

The way the Public Holidays penalty rate is calculated for Casual Employees varies depending on the Award. The applicable calculation methods are the same ones applied to calculate overtime rates. For more information, refer to the Blog: Fair Work update to Casual Overtime Clauses published on our website.

Can an employer agree to substitute Public Holidays with another day with one or more employees?

Public Holiday substitution rules are determined by the employee’s classified Award. When the Award allows the substitution of Public Holidays, Employers can agree to substitute a Public Holiday with another day with either an individual agreement or with all employees where the majority of employees agree with the substitution.

For example, a business that trades 365 days per year may agree with some of their Jewish employees to substitute Christmas and New Year’s Day Public Holidays with Hanukkah and Jewish New Year.

Another employer may agree with all its employees to substitute a Public Holiday falling on a Tuesday with the Monday to give everyone a long weekend. In this case, the majority of employees would need to vote in favour of the substitution.

As the rules about the substitution of public holidays always require agreement, neither an employee nor the employer can demand the substitution of a public holiday for another day if the other party does not agree to it.

Where the award or agreement is silent on the ability to substitute a public holiday, the business cannot offer this arrangement, even if the employees are agreeable. In this instance, employees are entitled to be paid penalty rates if they want to work on a Public Holiday.

Finally, award-free employees can agree with their employers to substitute the Public Holiday with an alternative day.

What happens when a Public Holiday falls on Payday?

Public Holidays also have an impact when they fall on payday. Generally, when a payday falls on a Public Holiday, employers are required to process their employees’ pay the previous workday.

However, some Awards have specific provisions on when payroll should be processed when payday falls on a Public Holiday. Once again, employers should carefully review their Industry Award to ensure they pay employees on time.

National versus State and Territories Public Holidays

There are two types of Public Holidays: National and state or territory Public Holidays.

National Public Holidays are listed in Section 115 of the Fair Work Act, and they include a total of 8 days. These are:

- New Year’s Day (1 January);

- Australia Day (26 January);

- Good Friday;

- Easter Monday;

- ANZAC Day (25 April);

- The Sovereign Birthday Holiday (on the day on which it is celebrated in the State or Territory the employee resides);

- Christmas Day (25 December);

- Boxing Day (26 December).

State or territory Public Holidays are set out by the Public Holiday Act of the relevant State or Territory. Some state or territory Public Holiday legislations also include half-day public holidays and public holidays exclusively available to certain Industry sectors.

A list of current Public Holidays is available on the Fair Work Website. This page also includes information and links related to the additional state and territory Public Holidays.

Employees are entitled to the public holidays that fall in the state or territory where they are based for work, not where they work on the day of the Public Holiday.

What happens when a Public Holiday falls during a weekend?

Most Public Holidays fall on a specific day of the week (for example, Melbourne Cup Day falls on the 1st Tuesday of November). However, five Public Holidays fall on the same date each year, meaning in some years, these Public Holidays fall on a weekend. These are:

- New Years Day (1st of January);

- Australia Day (26th of January);

- ANZAC Day (25th of April);

- Christmas Day (25th of December);

- Boxing Day (26th of December).

The provisions of how to correctly pay Public Holiday penalty rates when Public Holidays fall on weekends are set out in the Public Holiday Act of the employee’s residing state or territory.

When a Public Holiday falls on a weekend, the state Public Holiday legislation sets out three possible rules:

- Addition > the actual Public Holiday falling on a weekend and the following weekday are both deemed Public Holidays. Both days attract Public Holiday penalty rates (as determined by the Award) for those employees who are rostered to work on Public Holidays (including Casuals).Full-time and Part-time employees who are not rostered to work those days are entitled to both days off with pay (if they are ordinarily rostered to work on both days). Casual employees not rostered on Public Holidays are not entitled to any paid days off;

- Substitution > If a Public Holiday is substituted, then the substitute day is regarded as the Public Holiday. The substitute day is the only day that attracts Public Holiday penalty rates (as determined by the Award) for those employees rostered to work on Public Holidays (including Casuals).Full-time and Part-time employees are only entitled to the substitute day off with pay (if they are ordinarily rostered to work on that day). Casual employees not rostered on Public Holidays are not entitled to any paid days off;

- No Provision > the Public Holiday remains the same day on the weekend. The Public Holiday is the only day that attracts Public Holiday penalty rates (as determined by the Award) for those employees rostered to work on Public Holidays (including Casuals).Full-time and Part-time employees are entitled to the Public Holiday day off with pay (if they are ordinarily rostered to work on that day of the weekend). Employees who work Monday to Friday do not receive any additional days off when a No Provision Public Holiday falls on a weekend.

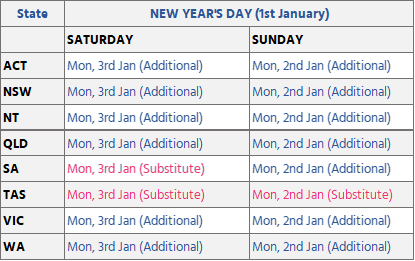

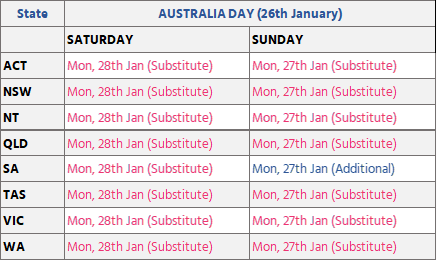

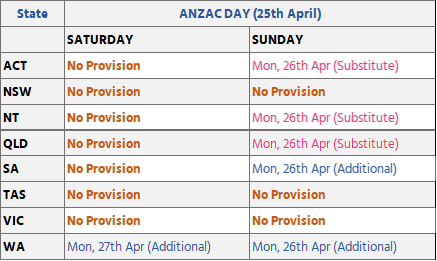

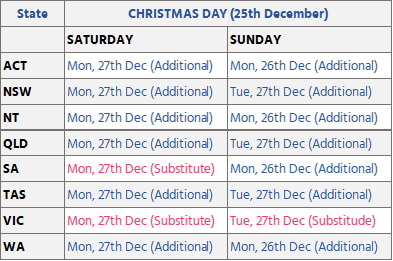

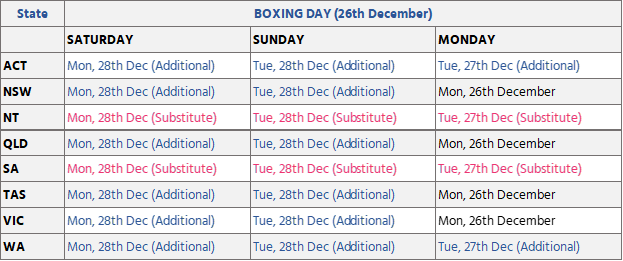

The following tables provide a summary of the treatment of Public Holidays falling on the weekend across each state or territory.

Table 1 – New Year’s Day falling on Weekends

Table 2 – Australia Day falling on Weekends

Table 3 – ANZAC Day falling on Weekends

Table 4 – Christmas Day falling on Weekends

Table 5 – Boxing Day falling on Weekends

How are Public Holidays paid when employees are on leave?

The treatment of Public Holidays also changes when a Public Holiday falls during periods of either paid or unpaid leave taken.

Annual & Personal/Carer’s Leave

When a Public Holiday falls whilst an employee is either on Annual Leave or Personal/Carer’s Leave, the Public Holiday is paid as ordinary hours of work and cannot be deducted from the employee’s leave balances.

However, if an employee is rostered to work on a Public Holiday on a day they wouldn’t normally work and calls in sick, they would not be entitled to be paid for that day.

Long Service Leave

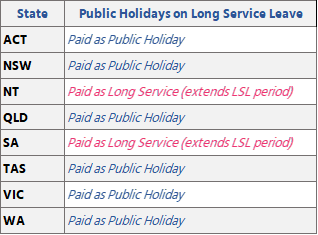

The correct treatment of Public Holiday whilst the employee is on Long Service Leave is determined by the Long Service Leave Act of the relevant state or territory.

Some Long Service Leave legislation requires the employers to pay the Public Holiday as Public Holiday and others as Long Service Leave (where the period of Long Service Leave is extended by the number of Public Holidays falling during the leave period taken).

The following table provides a summary of how Public Holidays are treated when falling during a period of Long Service Leave as per the Long Service Leave Act of the relevant state or territory.

Table 6 – Public Holidays whilst on Long Service Leave

Rostered Day Off

The rules for paying a Public Holiday falling on the same day as a Rostered Day Off vary depending on the employee’s classified Award. Employers should review the employee’s Award to understand the applicable rules.

Workers’ Compensation

Employers are not required to pay Public Holidays to any employees absent on Workers’ Compensation, as Workers’ Compensation will include the day in their weekly payment to the employer. In this instance, the Public Holiday is reported and paid as Workers’ Compensation (with relevant impact on Super and leave accruals).

Community Service Leave

When a Public Holiday falls whilst an employee is on Community Service Leave (including Jury Duty), the employer is not required to pay the Public Holilday.

Parental Leave

Employers are not required to pay Public Holidays to any employees absent on Parental Leave.

Unpaid Leave

Generally, an employee is not entitled to be paid for a Public Holiday when this falls during a period of leave without pay, providing the unpaid leave period is on both sides of the Public Holiday.

However, several exceptions apply to this rule. For example, this rule does not apply during periods of unpaid leave when the employee is directed to take leave due to either a shutdown or stand-down period.

Furthermore, some Awards have specific provisions on when the payment of Public Holidays is stopped whilst the employee is absent on unpaid leave. Once again, employers are encouraged to review their classified Award before not paying a Public Holiday and ending up committing wage theft.

What happens when a Public Holiday happens during a shut-down period?

Specific rules also apply during business shutdowns.

Christmas Shut-Down

Employers must pay Public Holidays to all their employees during a Christmas Shutdown. This requirement applies to both employees who have enough paid leave accrued to cover the shut-down period and those who have to take leave without pay.

Stand-downs

Employers must pay Public Holidays to all employees during any stand-down periods when the business is forced to close due to circumstances beyond its control, including:

- equipment breakdown;

- industrial action;

- weather conditions;

- enforceable government directions.

Key Takeaways and Tips for Employers

It is important for employers to keep on top of how public holidays may affect their staff, calculate and report the correct penalty rates and the specific Public Holidays the business plans to trade.

To correctly manage, roster and pay employees on Public Holidays, Employers should:

- Review the Public Holiday legislation of each state and territory where their employee resides. Key areas to check are:

- Additional Public Holidays set out by the relevant state or territory;

- Provision when Public Holidays fall on weekends;

- Restraint of trade during certain public holidays;

- Review their Industry Awards. Key areas to check are:

- Applicable rules that allow for substitution of Public Holidays;

- The correct penalty rates applicable to Permanent staff, casual employees and shiftworkers;

- Minimum rostered hours when employees are required to work on Public Holidays;

- Applicable rules to paying public holidays during unpaid leave;

- Applicable rules to managing public holidays that fall on the same day as an employee’s RDO;

- Applicable rules to paying employees when the Public Holiday falls on payday;

- Review the way Public Holidays are managed in their Payroll Software, including:

- Is the Public Holiday automatically deducted from any paid leave periods?;

- Are Public Holiday worked pay items set up correctly and do they pay the correct penalty rates for the different types of workers. Furthermore, are these pay items included in the calculation of superannuation and leave accruals where deemed Ordinary Time Earnings?

- Is the list of Public Holidays up to date across all relevant states?

- Review their HR Policies and Procedures, in particular:

- Are requests for workers to work Public Holidays tracked and/or documented?

- Are any substitution agreements between Public Holidays and other days submitted on each instance?

- Are these agreements properly recorded?

- Do Employment agreements or company policies include provisions to be rostered on Public Holidays?

More importantly, do you, as an employer and/or your payroll/admin staff, have the required knowledge to manage these complex entitlements?

If not, it is time to outsource your payroll to an expert!

References

Fair Work – Directing Employees to take Annual Leave

Fair Work – Shutting Down over Christmas and New Year

Fair Work – Federal Public Holidays

Fair Work – List of Public Holidays

NSW – Public Holidays Act 2010

TAS – Statutory Holidays Act 2000

VIC – Public Holidays Act 1993